Helium Mobile is rapidly rewriting the playbook for U. S. telecommunications, blending real-world network utility with on-chain incentives in a way that legacy carriers simply cannot match. This isn’t just about speculation or token hype; it’s about tangible, measurable usage and a business model that directly rewards those who power the network. As of November 2025, Helium (HNT) trades at $2.33, and the underlying fundamentals are more compelling than ever.

Explosive Growth in Data Offloading: The Numbers Tell the Story

The most striking evidence of Helium Mobile’s disruption is in its data transfer metrics. In Q2 2025 alone, the network offloaded over 2,721 terabytes (TB) of data from major U. S. mobile carriers, a staggering 138.5% increase from the previous quarter. Since launch, more than 5,520 TB have been routed through this decentralized mesh, making it clear that Helium is not just a proof-of-concept but a functioning alternative to traditional telecom infrastructure.

This offloading isn’t a marginal technical feat; it represents real value for both users and established carriers. By tapping into tens of thousands of user-operated hotspots, companies like AT and T can reduce their own infrastructure costs while expanding coverage into previously underserved areas. Explore how carrier offload on Helium works.

User Adoption: From Niche to Mainstream

The growth in subscriber numbers puts to rest any doubts about demand for community-owned telecom alternatives. By Q2 2025, Helium Mobile had registered over 311,200 accounts, up an eye-catching 94% quarter-over-quarter. The reasons are straightforward: service plans range from free to $30 per month, far below most legacy offerings, and coverage continues to improve as hotspot density increases.

This isn’t just an urban phenomenon either; rural and suburban users are increasingly turning to Helium as traditional providers struggle with last-mile economics. The model’s flexibility allows anyone with a compatible hotspot to become part of the network and share in its rewards.

Tokenomics and On-Chain Rewards: Real Usage, Real Value

The economic engine behind this growth is Helium’s unique incentive structure. Hotspot operators earn HNT tokens for providing coverage and facilitating data transfers, a direct link between network utility and participant rewards. In 2024-2025, Data Credit burns (representing actual network revenue) surged dramatically: daily averages jumped from $16,300 to $48,000 within weeks according to SolanaFloor.

This surge is not abstract; it reflects real dollars spent by users and carriers on wireless connectivity, fueling both HNT demand and burn rates. Nearly 160,000 HNT have been burned since January 2024 alone, over $1.47 million at current prices, demonstrating that this ecosystem is generating genuine economic activity rather than speculative churn.

Helium (HNT) Price Prediction 2026-2031

Professional forecast based on current adoption, network growth, and market trends as of November 2025

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.90 | $2.80 | $4.20 | +20% | Continued growth in user adoption, but possible volatility from macro crypto cycles. |

| 2027 | $2.30 | $3.55 | $5.60 | +27% | Regulatory clarity and further integration with carriers; risk from broader market corrections. |

| 2028 | $2.80 | $4.30 | $6.80 | +21% | Decentralized telecom model gains traction internationally, boosting demand for HNT. |

| 2029 | $2.60 | $4.00 | $7.50 | -7% | Potential competition and network maturation; price consolidation likely unless new use cases emerge. |

| 2030 | $2.95 | $4.85 | $8.90 | +21% | Major telecom adoption and DePIN sector growth could drive renewed bullish momentum. |

| 2031 | $3.30 | $5.60 | $10.30 | +15% | Widespread decentralized coverage and global partnerships; increased demand for HNT as network utility expands. |

Price Prediction Summary

Helium (HNT) is poised for moderate but steady price appreciation from 2026 through 2031, driven by ongoing network expansion, user growth, and strategic telecom partnerships. While volatility and cyclical corrections are expected, the token’s real-world utility and adoption trends support a bullish long-term outlook, with potential for significant upside if decentralized telecom becomes mainstream.

Key Factors Affecting Helium Price

- Explosive growth in network data usage and subscriber numbers (e.g., 94% QoQ user growth in Q2 2025)

- Strategic partnerships with major telecoms (AT&T, Telefónica) expanding network reach and credibility

- Halving of annual HNT emissions in 2025 reduces sell pressure and may support price

- Regulatory developments in the US and globally could impact adoption and perceived risk

- Technical improvements and expansion of DePIN (decentralized physical infrastructure) use cases

- Broader crypto market cycles and investor sentiment

- Competition from both traditional carriers and emerging decentralized networks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

A New Paradigm for Community-Owned Telecom

The implications are profound: by aligning incentives across users, infrastructure owners, and even incumbent carriers through on-chain rewards, Helium is building a telecom stack that scales organically with demand, not top-down capital expenditure cycles. Learn more about how community ownership changes telecom dynamics.

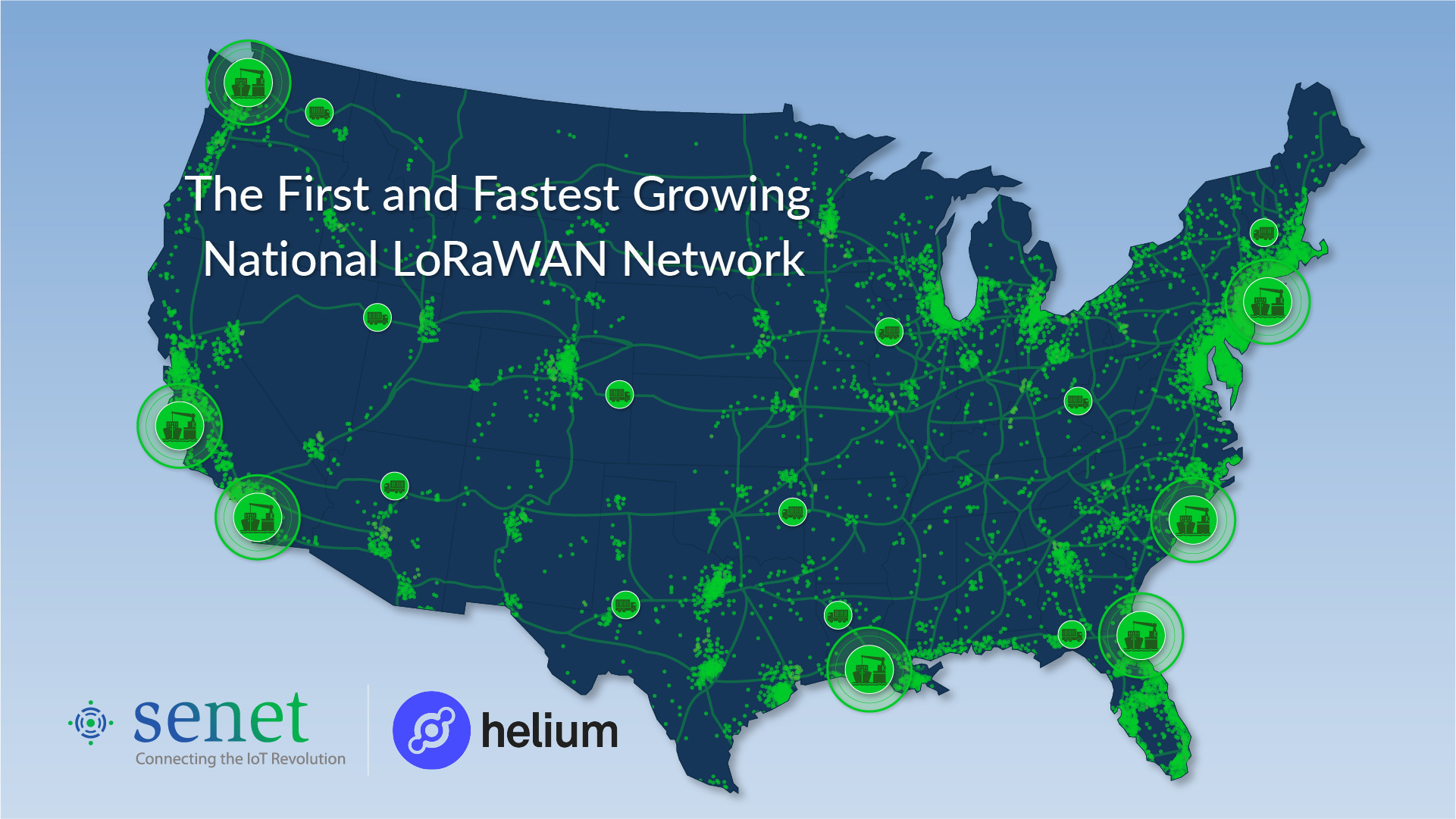

Helium’s model is already inspiring a new generation of DePIN wireless projects, but its lead remains substantial thanks to network effects and relentless execution. With nearly 370,000 active hotspots (279,000 IoT and 97,000 Mobile) and more than 1,000 units added each week, the coverage gap with legacy players is closing rapidly. The network’s ability to route millions of daily connections, now often exceeding those of established IoT networks, signals a shift in how Americans think about who provides their connectivity and why.

For investors and industry observers, the story isn’t just about user numbers or even revenue, it’s about the sustainability of a decentralized telecom model. The upcoming reduction in annual HNT emissions (from 15 million to 7.5 million HNT) will cut daily emissions to 20,548 HNT, but crucially, hotspot data rewards remain untouched. This careful balancing act supports long-term price appreciation for contributors while ensuring ongoing network growth. At $2.33, HNT reflects both current utility and future optionality as adoption accelerates.

The tokenomics are further strengthened by the burn mechanism: as Data Credit usage increases, now averaging $48,000 per day: the circulating supply of HNT is continually reduced. This feedback loop ties protocol health directly to real-world usage statistics rather than speculative flows alone. It’s a rare alignment between crypto incentives and tangible service delivery.

What Comes Next? Scaling Beyond Early Adopters

The next phase for Helium Mobile is clear: move from early adopter momentum to mass-market relevance. Strategic partnerships with AT and T and Telefónica have validated the model at scale, while ongoing improvements in hardware availability and onboarding are lowering barriers for new participants. As coverage expands into more rural areas, and as more devices become natively compatible with Helium’s protocols, the path toward millions more users looks increasingly attainable.

This trajectory isn’t without challenges: regulatory scrutiny, device compatibility issues, and competition from both centralized incumbents and emerging DePIN rivals all loom large. But Helium’s transparent on-chain metrics provide an uncommon level of accountability, anyone can track user growth, data offload volumes, or Data Credit burns in real time via public dashboards.

Why This Matters for the Future of Wireless

If you care about affordable access, privacy by design, or simply want your telecom dollars to work harder for your community, not just distant shareholders, Helium Mobile offers a credible vision for what comes next. Its blend of open infrastructure and direct economic participation marks a fundamental break from business-as-usual telecom models.

The U. S. wireless market hasn’t seen this level of bottom-up disruption in decades, and with every terabyte offloaded or hotspot activated, Helium moves one step closer to making decentralized connectivity part of everyday life.