Helium Network’s adoption curve in 2025 is not just a headline story – it’s a data-driven transformation of the wireless landscape. As of November 13,2025, Helium (HNT) trades at $2.23, reflecting ongoing market confidence in the project’s real-world traction and revenue growth.

Record Data Offloading: Measuring Real-World Usage Metrics

By the end of Q2 2025, Helium Network had offloaded 2,721 terabytes of mobile data from major U. S. carriers – a staggering 138.5% increase quarter-over-quarter. This surge isn’t just statistical noise; it signals that decentralized wireless infrastructure is being adopted as an alternative for both end users and enterprise partners. The scale of this offloading demonstrates Helium’s growing role as a backbone for mobile traffic, especially as traditional carriers like AT and T and Telefónica leverage Helium’s coverage to reduce their own network congestion and costs.

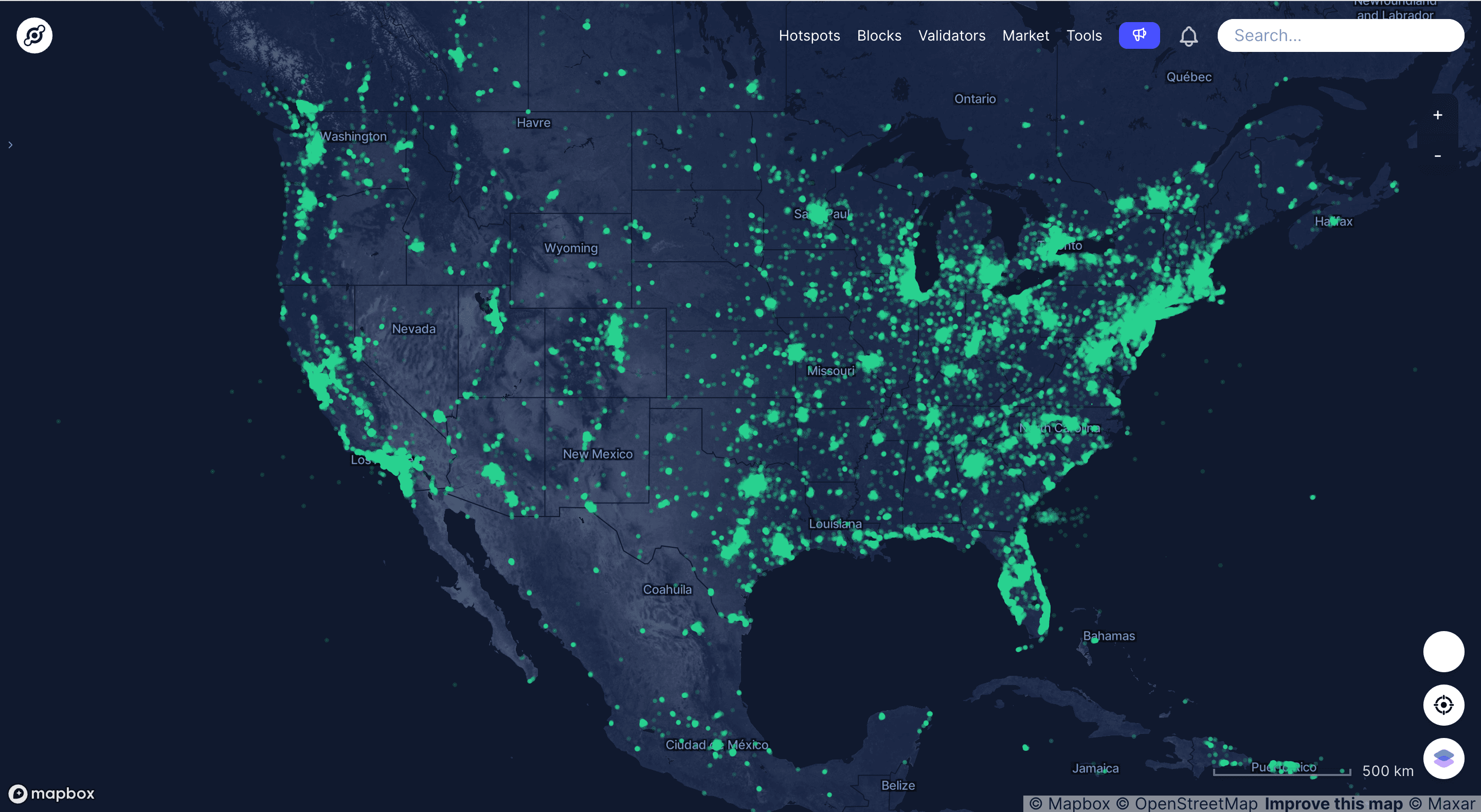

The primary driver? A rapidly expanding hotspot network, now at over 380,900 active nodes worldwide. These community-operated hotspots are not only increasing coverage but also making decentralized connectivity economically viable for new geographies and demographics.

User Growth and Subscriber Surge: Quantifying Adoption Momentum

The user base is expanding at an unprecedented rate. By Q2 2025, Helium Mobile accounts jumped by 94.1%, rising from 160,300 to 311,200 in just one quarter (see detailed breakdown here). Daily active users hit 1.2 million, up 35% quarter-over-quarter, with paid mobile traffic surging by 57.3% to reach 32.4 TB per day. This isn’t theoretical adoption – these are real subscribers using Helium-powered devices for everyday connectivity needs.

The introduction of Helium Plus in July 2025 further accelerated growth by allowing businesses to join the network using existing WiFi routers, eliminating hardware costs and lowering the barrier to entry for commercial venues.

Diversified Revenue Streams Fueling Network Expansion

Revenue metrics underscore the sustainability of this adoption wave. In Q3 2025, Helium’s annualized revenue reached $18.3 million, powered by three main streams:

- Mobile subscriptions: Recurring payments from individual users leveraging Helium Mobile SIMs.

- WiFi offload agreements: Partnerships with major carriers (e. g. , AT and T) have resulted in over $300,000 paid out in carrier offload fees in June alone (full revenue stream analysis here).

- The Helium Plus upgrade program: Targeting commercial venues seeking seamless integration without new hardware investments.

A key innovation driving value capture is the buyback-and-burn model for subscriber revenue: average daily Data Credit burns soared by 196% quarter-over-quarter, reaching $30,920 daily in Q3. This mechanism not only aligns tokenomics with actual usage but also incentivizes long-term holding among HNT stakeholders.

Helium (HNT) Price Prediction 2026-2031

Projected HNT price ranges based on network adoption, revenue growth, and real-world usage metrics (2025 baseline: $2.23)

| Year | Minimum Price | Average Price | Maximum Price | Y/Y % Change (Avg.) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.85 | $2.70 | $4.10 | +21% | Steady growth as Helium capitalizes on expanded carrier partnerships and the Helium Plus rollout; volatility possible with broader market trends. |

| 2027 | $2.10 | $3.40 | $5.60 | +26% | Further adoption in enterprise and IoT sectors; increased token burns and revenue diversification push price upward. |

| 2028 | $2.50 | $4.30 | $7.10 | +26% | Global hotspot expansion and mass usage drive network effect; regulatory clarity in major markets supports bullish sentiment. |

| 2029 | $2.90 | $5.10 | $8.80 | +19% | Maturing DePIN sector, Helium’s user base stabilizes above 2 million daily; competition from other DePIN projects may impact upside. |

| 2030 | $2.60 | $4.70 | $8.00 | -8% | Market correction phase; consolidation after rapid growth, but strong ecosystem and real-world use cases provide price floor. |

| 2031 | $2.90 | $5.50 | $9.20 | +17% | Renewed bullish cycle with global DePIN/IoT integration; Helium cements leadership, with new partnerships and advanced use cases. |

Price Prediction Summary

Helium (HNT) is positioned for progressive growth through 2031, with average prices potentially more than doubling from current levels if network adoption and revenue trends continue. While volatility and corrections are likely, the project’s expanding real-world footprint, recurring revenue streams, and tokenomics (burn model) support a strong long-term outlook.

Key Factors Affecting Helium Price

- Consistent growth in network usage and data offloading volumes

- Expansion of Helium Mobile and Helium Plus programs

- Token burn mechanisms reducing supply

- Strategic partnerships with telecom carriers (e.g., AT&T, Telefónica)

- Competitive landscape in DePIN and decentralized wireless sectors

- Potential regulatory developments in the U.S. and globally

- Broader crypto market cycles and investor sentiment

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Global Hotspot Footprint: Infrastructure Scaling Meets Decentralization Ethos

The physical backbone supporting this momentum is the ever-growing fleet of hotspots – surpassing 380,900 units globally by mid-2025. These nodes span more than eighty countries and provide LoRaWAN as well as cellular coverage for both IoT devices and consumer smartphones. The decentralized ownership model continues to attract new participants seeking yield from real-world wireless activity rather than speculative mining alone.

This global footprint isn’t just a technical milestone, it’s a validation of Helium’s DePIN (Decentralized Physical Infrastructure Network) thesis. By distributing rewards directly to hotspot operators, the network scales organically, matching demand with coverage in real time. This has allowed Helium to rapidly fill service gaps in both urban and underserved rural areas, where traditional telecom business models often falter due to cost constraints or regulatory complexity.

Importantly, the diversity of deployments, from LoRaWAN IoT sensors tracking logistics and environmental data to 5G-enabled consumer handsets, demonstrates Helium’s flexibility as a platform. As more devices connect via decentralized infrastructure, the value proposition for both users and operators strengthens, creating positive feedback loops that drive further adoption and network resilience.

Tokenomics in Action: Data Credits Burn and HNT Supply

The relationship between real-world usage metrics and token economics is now quantifiable. The Data Credit burn rate, tied directly to actual data transferred on the network, reached new highs in Q3 2025, up 196% quarter-over-quarter. Each gigabyte offloaded translates into HNT being bought back from the open market and burned, reducing circulating supply. At the current price of $2.23, this dynamic is increasingly relevant for both investors and operators seeking sustainable yield rather than speculative hype.

This model contrasts sharply with legacy telecoms, where user fees rarely translate into transparent economic alignment with infrastructure providers or end users. Instead, Helium’s approach ensures that increased adoption benefits all stakeholders directly, creating a rare alignment between utility, community growth, and tokenholder value.

Strategic Partnerships: Accelerating Enterprise Adoption

Partnerships with established carriers like AT and T and Telefónica are not just headline deals, they are critical catalysts for mainstream adoption. These collaborations have already resulted in significant offload payments (over $300,000 in June 2024 alone) and are expected to scale as mobile traffic continues its upward trajectory. For enterprises, programs like Helium Plus offer seamless onboarding by leveraging existing WiFi hardware, a move that reduces friction for venue operators while expanding Helium’s reach into commercial real estate, hospitality, retail, and logistics sectors.

The result is a network effect where every additional business or carrier partner increases coverage density and reliability for all users, a virtuous cycle that traditional wireless incumbents struggle to replicate at comparable cost or speed.

Risks and Forward-Looking Metrics

No growth story is without risks. Regulatory headwinds remain a concern as decentralized wireless models challenge entrenched interests. Network reliability must keep pace with expectations as daily active users climb past 1.2 million. Sustained Data Credit burns, and thus HNT price support, depend on continued expansion of real-world usage rather than one-off incentives or speculative activity.

However, the data-driven momentum through Q3 2025 suggests robust fundamentals underpinning Helium’s trajectory. Investors should watch:

- Sustained growth in daily active users and paid traffic volumes

- The pace of new hotspot deployments across emerging markets

- Evolving regulatory frameworks impacting decentralized spectrum use

- The success rate of enterprise onboarding via Helium Plus partnerships

Helium Network: A Leading Indicator for DePIN Wireless Markets?

Helium’s performance in 2025 positions it as more than just an experiment, it is now a leading indicator for decentralized wireless (DePIN) market viability at scale. With annualized revenue at $18.3 million, record Data Credit burns at $30,920 per day, over 1.2 million daily users, and a current token price holding steady at $2.23, the project is setting benchmarks others will be measured against.

If these trends persist through 2026, especially amid ongoing partnerships with major carriers, the case for blockchain-powered connectivity will only strengthen across both consumer mobile and IoT verticals.

For deeper dives into subscriber growth dynamics or detailed revenue breakdowns by stream, including how WiFi offload agreements are reshaping telecom incentives, explore our analysis here: Helium Network Revenue Streams: Subscriptions, WiFi Offload and More.