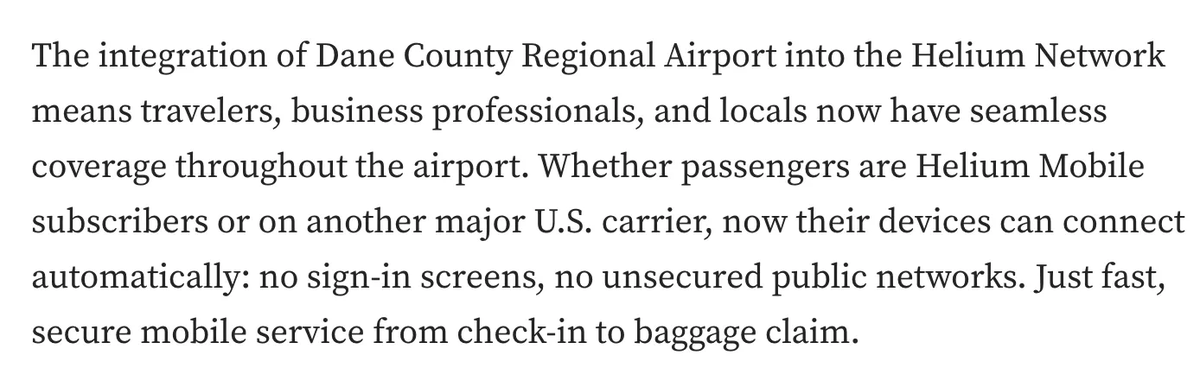

In the bustling terminals of Dane County Regional Airport in Madison, Wisconsin, approximately 200,000 travelers monthly now tap into a decentralized wireless revolution. Since August 2025, Helium hotspots have blanketed the facility, delivering seamless Helium network traveler connectivity without the hassle of public Wi-Fi logins. This Madison Airport Helium deployment marks a pivotal moment for DePIN airport WiFi 2025, where blockchain incentives power reliable coverage in high-traffic decentralized wireless venues.

Helium’s model flips traditional infrastructure on its head. Hotspot operators earn HNT tokens by providing coverage, proof-of-coverage validates network quality, and data credits burned for usage create deflationary pressure on the token. At Madison Airport, this translates to automatic connections for AT and amp;T customers via over 93,500 U. S. hotspots, including those strategically placed across gates, lounges, and baggage claim. Travelers experience low-latency mobile service, sidestepping congested carrier towers during peak hours.

Carrier Offload Unlocks Airport Revenue Streams

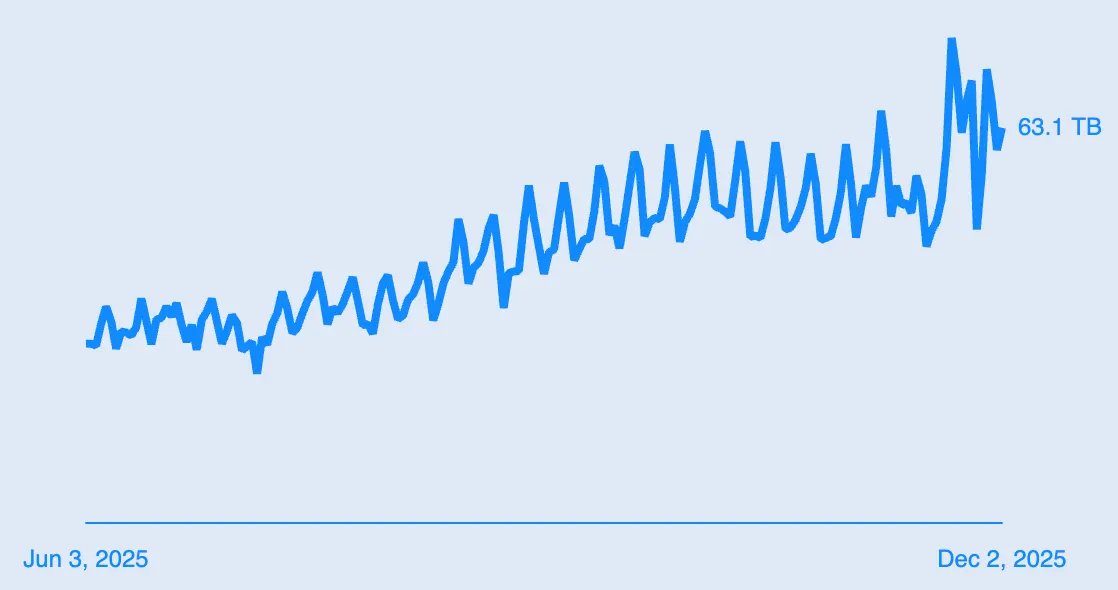

The genius lies in WiFi offload. Major carriers route excess data through Helium’s network, compensating hosts per gigabyte. In June 2025, payouts exceeded $300,000, climbing 20% month-over-month. For Madison Airport, this introduces a passive income layer; every offloaded GB from the 200,000 travelers fuels new revenue streams. Airports evolve from cost centers to HNT-burning machines, as data usage torches credits and tightens token supply.

“Madison Airport got a power up from @Helium this year. . . now, every traveller has an automatic connection to Helium hotspots, airports can become the ultimate $HNT burning machine. ” – HNTbandit on X

Technically, Helium Mobile’s offload protocol prioritizes local hotspots, minimizing latency while maximizing rewards. AT and amp;T’s April 2025 partnership accelerates this, blending centralized carriers with decentralized edges. Quantitative edge: hotspot deployments surged 227% YTD to 109,754, correlating with a 194% data credit burn rate spike. HNT at $1.97 reflects this momentum, up 2.6% in 24 hours from a $1.92 low.

Decentralized Incentives Drive Network Expansion

Helium’s incentive loop is elegantly simple yet profoundly scalable. Deploy a hotspot, prove coverage via radio frequency challenges, earn HNT. In venues like airports, density amplifies utility; overlapping signals ensure redundancy, critical for 200K users streaming, working, or navigating. Messari’s Q3 2025 report underscores this: individual operators expand the network, carriers offload traffic, HNT utility soars. Sarson Funds notes Helium’s 2025 leadership in decentralized wireless, with user adoption fueling sustained growth.

Helium Network Token (HNT) Price Prediction 2026-2031

Projections based on DePIN airport deployments, carrier offload growth, hotspot expansion, and HNT utility burn amid 2025 market momentum (Current price: $1.97)

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $3.20 | $6.80 | $12.50 |

| 2027 | $4.80 | $10.50 | $22.00 |

| 2028 | $6.50 | $16.00 | $32.00 |

| 2029 | $9.00 | $24.00 | $48.00 |

| 2030 | $12.50 | $34.00 | $65.00 |

| 2031 | $17.00 | $48.00 | $95.00 |

Price Prediction Summary

HNT exhibits strong bullish potential driven by real-world DePIN adoption, including Madison Airport’s hotspot integration serving 200K travelers, AT&T partnerships, 227% YTD hotspot growth, and 194% Data Credit burn increase. Average prices are forecasted to rise progressively from $6.80 in 2026 (+245% from current) to $48.00 in 2031 (CAGR ~48%), with max scenarios reflecting full carrier offload scaling and bull market cycles; min prices account for bearish volatility and competition.

Key Factors Affecting Helium Network Token Price

- Explosive hotspot growth (227% YTD to 109K+ units) boosting network coverage

- Carrier offload revenue (e.g., AT&T payouts >$300K/month, +20% MoM)

- Airport DePIN deployments creating HNT burn via high-traffic WiFi offload

- Elevated Data Credit burn rate (194% up) reducing supply pressure

- DePIN sector leadership and user adoption trends

- Crypto bull cycle alignment post-2025 with utility token demand

- Potential regulatory tailwinds for decentralized wireless infrastructure

- Risks: market volatility, competition from centralized providers, supply dynamics

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

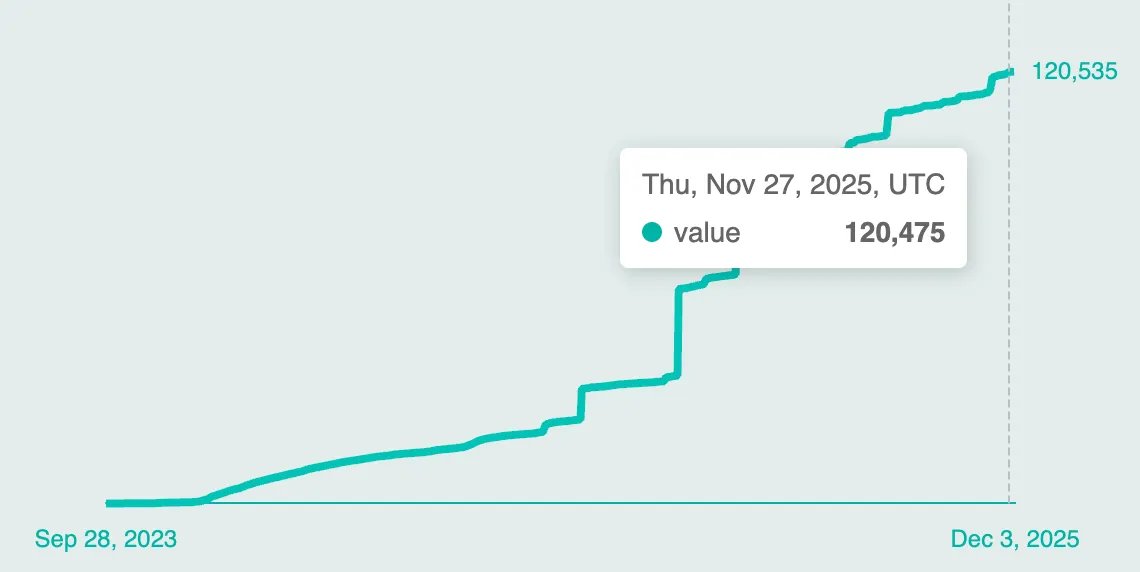

Consider the metrics. From January’s 33,409 hotspots to today’s 109,754, capacity has exploded. Reddit’s r/HeliumNetwork buzzes with “hogs” eyeing carrier negotiations; broader coverage means better leverage. DePIN Central highlights how Helium hotspots airports transform connectivity, while Altcoin Buzz details the seamless integration at Madison. This isn’t hype; it’s quantifiable proof-of-coverage yielding real-world results.

Technical Edge in High-Density Environments

Airports demand low downtime, high throughput. Helium delivers via LoRaWAN for IoT and 5G CBRS for mobile, now augmented by WiFi offload. CBRS spectrum unlocks carrier-grade speeds without auctions, a regulatory hack for DePIN. At Madison, hotspots handle peak loads, offloading to AT and amp;T when saturated. Innovation shines in the economics: $300K and monthly payouts scale with traffic, positioning airports as key nodes in a $1.97 HNT ecosystem poised for trillion-dollar potential, per CLIMB by VSC analysis.

DePIN Hub’s MHGA podcast reveals WiFi offloading’s traction; users route traffic locally, hotspots hum. SolanaFloor ties burn rates to HNT upside. As deployments proliferate, expect more venues to follow Madison’s lead, cementing Helium’s role in next-gen wireless.

These integrations don’t just patch coverage gaps; they rewire the economics of high-density venues like decentralized wireless venues. Madison’s setup exemplifies how Helium hotspots handle bursty traffic patterns, from boarding rushes to lounge dwell times, with CBRS bands delivering sub-50ms latencies that rival dedicated fiber links. Operators pocket rewards in real-time, creating a flywheel where more hotspots chase denser coverage, burning more Data Credits and pressuring HNT’s $1.97 price upward.

Metrics That Matter: Growth and Rewards Breakdown

Let’s dissect the numbers driving this surge. Hotspot counts ballooned 227% year-to-date, from 33,409 in January to 109,754 by Q3, per SolanaFloor data. This isn’t random sprawl; it’s targeted at offload sweet spots like airports. Carrier payouts hit $300,000 in June alone, with 20% monthly gains signaling exponential scaling. For Madison’s 200,000 travelers, even modest 10% offload penetration translates to thousands in monthly venue revenue, all while AT and T customers roam seamlessly across 93,500 and U. S. nodes.

Helium 2025 Key Metrics

| Metric | Value / Period | Growth / Notes |

|---|---|---|

| Hotspots Deployed | Jan: 33k to Q3: 110k | +227% YTD |

| DC Burn Rate | Up 194% | Since January |

| Hotspot Payouts | June: $300k | +20% MoM |

| HNT Price | $1.97 | Current |

Opinion: These figures scream undervaluation. At $1.97, HNT trades at a fraction of its utility, especially as WiFi offload protocols mature. DePIN Hub’s analysis shows users actively routing traffic through hotspots, amplifying burn rates and host yields. Reddit threads pulse with strategies for “hogs” to dominate carrier negotiations, leveraging airport-scale coverage for premium deals.

Milestones Paving the Path Forward

Tracing this trajectory reveals Helium’s maturation from IoT curiosity to mobile powerhouse. The April AT and T tie-up was the spark, enabling automatic offloads that now fuel Madison’s terminals. August’s rollout there tested real-world resilience, proving hotspots thrive amid interference-heavy environments. Q3’s explosion in deployments and burns sets the stage for Q4 acceleration, with Messari forecasting sustained HNT utility as more venues plug in.

Zoom out to the DePIN landscape: Helium leads where incumbents lag. Traditional carriers pour billions into towers, yet struggle with capex and urban density. Helium’s model sidesteps this, crowdsourcing infrastructure via token incentives. Airports gain dual wins – superior Helium network traveler connectivity and monetized spectrum. Travelers dodge data caps and spotty signals; hosts harvest HNT at $1.97, with 24-hour highs touching $2.00 amid and 2.6% gains.

Helium Mobile now supports WiFi offloading! With Helium Mobile growing fast and users actively offloading traffic through local hotspots. . . – DePIN Hub #046 MHGA

Challenges persist, sure – regulatory scrutiny on CBRS sharing, hotspot saturation risks. Yet Helium’s proof-of-coverage quells quality concerns, and partnerships like AT and T’s validate the stack. Sarson Funds pegs 2025 as Helium’s breakout, with HNT’s role in carrier offload cementing trillion-dollar ambitions outlined in CLIMB’s coverage loop: incentives build network, services consume it, tokens appreciate.

Forward thinkers see ripple effects. If Madison succeeds, expect O’Hare, LAX pilots by mid-2026, each amplifying network effects. Venues become DePIN hubs, offloading not just data but legacy WiFi dependencies. For investors, the trade is clear: position in HNT at $1.97 before airport adoptions cascade, tightening supply via relentless burns. This isn’t incremental; it’s the blueprint for wireless reborn on blockchain rails.