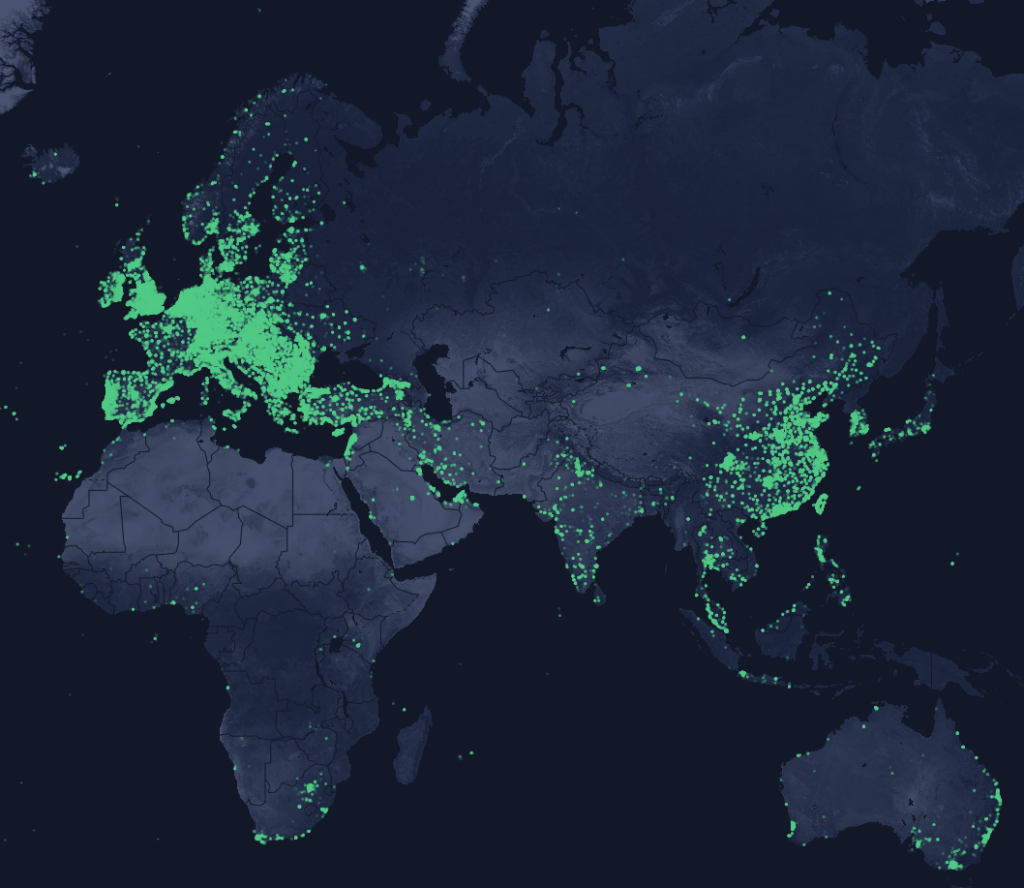

Helium’s International Waitlist for 2026 stands as a beacon for those eyeing the next wave of decentralized 5G countries and IoT proliferation. With hotspots already spanning over 170 nations and fresh partnerships accelerating helium global expansion 2026, communities from Latin America to beyond are lining up to host the people’s network. HNT hovers at $0.8114, a resilient figure amid a 24-hour dip of -0.0461%, underscoring investor confidence in Helium’s trajectory despite market whispers.

This waitlist isn’t mere bureaucracy; it’s a strategic pulse-check on global demand, prioritizing regions ripe for disruption. Helium replaces cumbersome cell towers with compact hotspots, empowering individuals to build coverage where life happens: cafes, campuses, rural outposts. The helium international waitlist captures emails and locations, funneling resources to high-potential zones and fostering collaborations with enterprises and carriers. Sign-ups surged post recent announcements, signaling a grassroots revolution in wireless infrastructure.

Brazil’s Mambo WiFi Pact Ignites Latin American Fire

In December 2025, Helium inked a pivotal deal with Brazil’s Mambo WiFi, thrusting its DePIN wireless networks into one of the world’s fastest-growing markets. This partnership promises to blanket Brazil with thousands of hotspots, blending Helium’s 5G prowess with Mambo’s local WiFi footprint. Analysts project 40,000 to 100,000 WiFi points onboarding swiftly, supercharging data usage and subscriber growth. For investors, it’s a tangible proof-point: Helium isn’t theorizing decentralization; it’s executing at scale.

Bill Tanner’s coverage in Intelligent CIO highlighted how this expansion, coupled with the waitlist launch, positions Brazil as a launchpad for broader LatAm dominance. Communities there, long underserved by traditional telcos, now stand to earn HNT rewards by deploying devices. I view this as a masterstroke, blending economic incentives with real utility; hotspots won’t just connect, they’ll monetize ambient airwaves.

Mexico’s Movistar Milestone: Carrier Convergence Accelerates

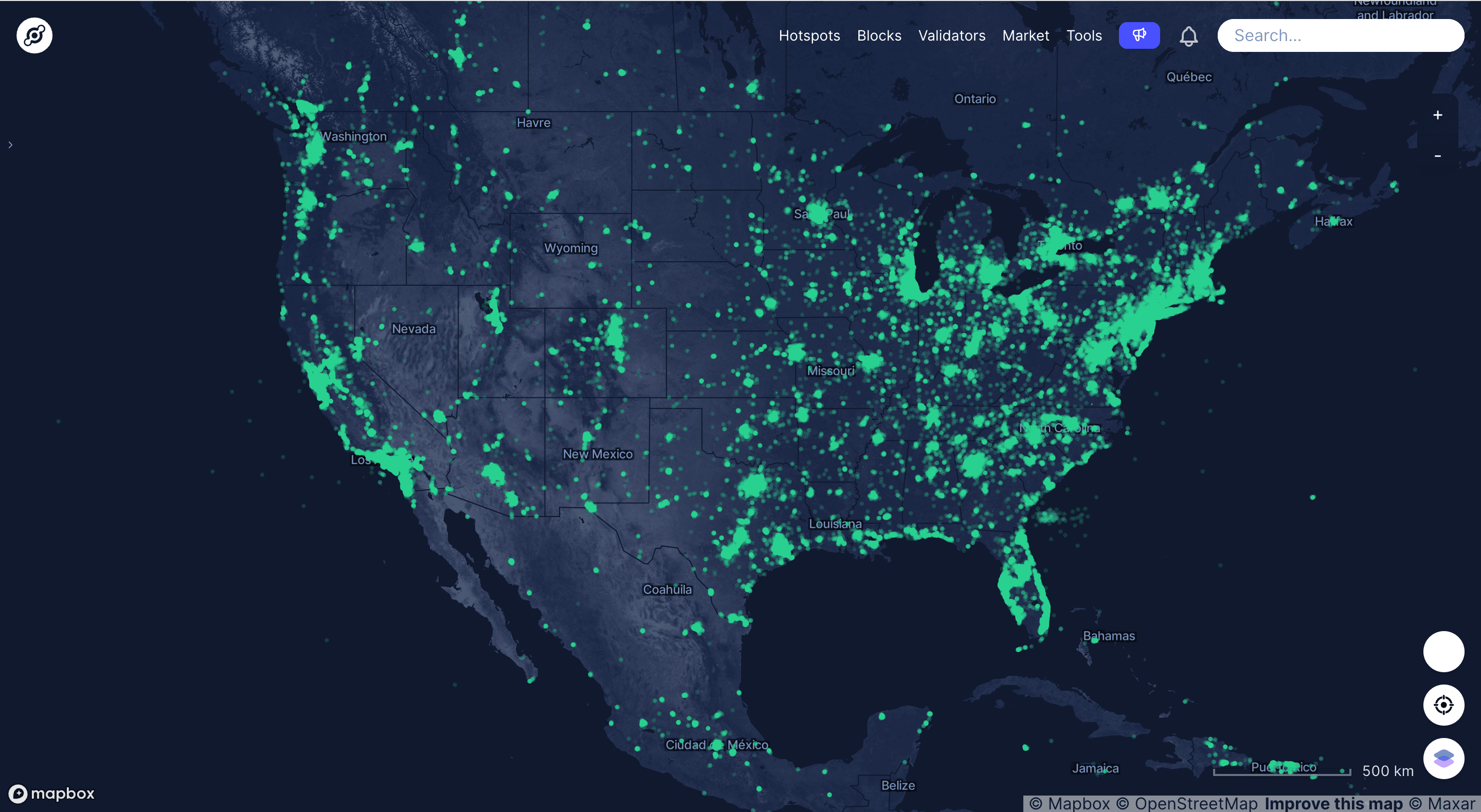

Flash back to February 2025, when Telefónica’s Movistar tapped Helium to bolster coverage for over 2 million Mexican subscribers. This integration targeted underserved pockets, marrying Helium’s decentralized hotspots with Movistar’s established base. It’s no coincidence that Mexico now hums with heightened helium mobile deployment activity, paving the way for the waitlist’s regional focus.

Helium Mobile’s “Zero Plan” further sweetens the pot, offering free 3GB data, 300 texts, and 100 minutes monthly. Such freemium models draw users en masse, amplifying network effects. From my vantage in equity research, these carrier tie-ups validate Helium’s hybrid model: blockchain-secured scalability on Solana meets carrier-grade reliability. Mexico exemplifies how decentralized 5G bridges incumbents and innovators, a template rippling outward.

Decoding the Waitlist: Fuel for 2026’s Network Explosion

The waitlist mechanism is elegantly simple yet profoundly data-driven. Users select countries and submit details, helping Helium map demand heatmaps. High-signup areas unlock priority deployments, from IoT sensors tracking shipments to 5G slicing for urban mobility. Reddit’s r/HeliumNetwork buzzes with 2026 predictions: explosive mobile hotspot adoption, subscriber surges, and data throughput spikes, propelled by Brazil and Mexico’s momentum.

Helium’s evolution from LoRaWAN roots to Solana-powered 5G underscores its foresight. Hotspots in 170 and countries already prove the concept; the waitlist scales it exponentially. For tech enthusiasts and investors, this is prime positioning: early waitlist engagement could yield first-mover advantages in helium IoT hotspots international rollouts. Check out how Helium powers IoT for deeper mechanics.

Helium (HNT) Price Prediction 2027-2032

Forecast based on international expansions, waitlist growth, and DePIN adoption in 5G/IoT networks

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.20 | $2.50 | $4.50 | +194% |

| 2028 | $2.00 | $4.00 | $7.00 | +60% |

| 2029 | $3.00 | $6.50 | $11.00 | +63% |

| 2030 | $4.50 | $10.00 | $16.00 | +54% |

| 2031 | $6.00 | $14.00 | $22.00 | +40% |

| 2032 | $8.00 | $19.00 | $30.00 | +36% |

Price Prediction Summary

Helium (HNT) is forecasted to experience robust growth from its current $0.81 level, driven by partnerships in Brazil and Mexico, international waitlist momentum, and expanding DePIN use cases. Average prices could reach $19 by 2032 in a baseline scenario, with bullish maxima reflecting adoption surges and market cycles, while minima account for potential bearish corrections.

Key Factors Affecting Helium Price

- Global expansions via Mambo WiFi in Brazil and Telefónica in Mexico

- International waitlist accelerating new country onboarding

- Rising demand for decentralized 5G and IoT networks

- Solana integration enhancing scalability and performance

- Crypto market cycles and increasing DePIN sector maturity

- Regulatory progress in emerging markets

- Hotspot deployments and subscriber growth boosting network utility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Forward-looking portfolios demand exposure here. As HNT stabilizes at $0.8114, the waitlist heralds a phase where community readiness dictates velocity. Enterprises scouting DePIN wireless for IoT fleets should monitor closely; the network’s proof-of-coverage consensus ensures reliability rivals centralized giants.

Picture a world where connectivity isn’t dictated by corporate giants but crowdsourced from rooftops and backyards worldwide. That’s the promise of Helium’s helium international waitlist, channeling sign-ups into actionable expansion blueprints. High-density interest from Southeast Asia, parts of Europe, and Africa could tip the scales for 2026 rollouts, mirroring Brazil’s trajectory.

Southeast Asia and Beyond: Waitlist Signals Untapped Potential

While Brazil and Mexico lead headlines, the waitlist reveals broader appetites. Urban centers in Indonesia, Philippines, and India show surging interest, per community forums. These regions grapple with patchy infrastructure, making Helium’s model a natural fit: low-cost hotspots yielding HNT at $0.8114 per token reward. Investors should note how such diversification mitigates regional risks, fortifying the network’s resilience.

Helium’s Solana migration has been pivotal, slashing transaction costs and boosting throughput for 5G demands. This technical backbone supports the waitlist’s ambition, enabling seamless scaling as hotspots proliferate. From my 11 years tracking tech equities, networks that harness tokenomics for growth like this rarely falter; they compound.

Investor Playbook: Positioning for DePIN Dominance

HNT’s steady $0.8114 price, after touching a 24-hour high of $0.8507, reflects maturing sentiment. Waitlist momentum could catalyze breakouts, especially if Q1 2026 unveils new carrier pacts. Pair this with Helium Mobile’s Zero Plan traction; free tiers virally onboard users, spiking data credits and hotspot ROI.

For portfolios, allocate thoughtfully: DePIN isn’t hype, it’s infrastructure reborn. Helium’s proof-of-coverage mechanism guarantees utility, outpacing speculative plays. Enterprises eyeing IoT for supply chains or smart cities will flock here, drawn by cost savings over legacy towers.

Key Helium Hotspot Advantages

-

Earn HNT Rewards: Hotspot owners earn HNT ($0.8114) by providing coverage, fueling participation amid expansions like Brazil’s Mambo WiFi partnership.

-

Expand 5G/IoT Coverage: Deploy hotspots to boost decentralized 5G and IoT in underserved areas, as seen with Telefónica Movistar in Mexico reaching 2M+ subscribers.

-

Community-Driven Growth: International Waitlist empowers global communities and enterprises to drive network expansion, like Brazil onboarding 40-100k WiFi points.

-

Low Entry Barriers: Affordable hotspots replace costly cell towers, enabling anyone to contribute to coverage where people gather, work, and move.

-

Scalable on Solana: Built on Solana blockchain for high scalability, supporting hotspots in 170+ countries and future global 5G growth.

Communities joining via the waitlist gain more than connectivity; they claim ownership in a borderless grid. Brazil’s Mambo integration exemplifies rewards: WiFi points transmuting idle spectrum into revenue streams. Mexico’s Movistar synergy proves carriers amplify, not compete.

Charting 2026: From Waitlist to Worldwide Web

Envision 2026: hotspots numbering in the millions, 5G slicing IoT ecosystems from agriculture sensors to autonomous fleets. The waitlist democratizes this vision, prioritizing where passion meets need. Reddit prognosticators forecast subscriber doublings, data usage exploding via 40,000-100,000 new points in LatAm alone.

Dive deeper into Helium’s 5G hotspots powering IoT; it’s the engine for tomorrow’s deployments. As HNT holds $0.8114 amid minor volatility, the network’s fundamentals shine: 170 countries live, expansions queued, blockchain fortifying every transmission.

This isn’t incremental progress; it’s a paradigm shift. Communities worldwide, from Brazilian favelas to Mexican hinterlands, are scripting Helium’s saga. Investors and innovators alike should heed the waitlist call, securing stakes in the air we all breathe digitally. The future connects through us.