Helium Mobile’s ascent to nearly 3 million users by early 2026 marks a pivotal inflection point for DePIN 5G networks, where surging demand translates directly into aggressive HNT burns. With daily active users (DAUs) climbing from 2.5 million in late December 2025, this growth underscores the network’s maturation from niche experiment to viable telecom disruptor. Customer payments fuel the Burn-and-Mint Equilibrium model, purchasing data credits denominated in HNT at current market rates, systematically reducing circulating supply while rewarding hotspot operators with MOBILE tokens based on location, uptime, and usage intensity.

At $0.9296 per HNT, the token’s modest 24-hour gain of and $0.1218 reflects underlying network strength amid broader market volatility. Daily data credit burns, which hit $50,000 by late 2025, continue to escalate, supported by 113,891 hotspots and strategic carrier partnerships for offloading traffic. This dynamic positions Helium as a deflationary force in decentralized wireless 5G 2026, where blockchain-secured coverage slashes traditional infrastructure costs.

Helium Mobile Users Propel Network Scale

The leap to 2.9 million helium mobile users stems from aggressive sign-ups nearing 600,000 by year-end 2025, bolstered by the Helium Plus program launched in July. This initiative integrates existing business routers and public Wi-Fi into the network, expanding coverage without massive capex. DAUs jumped 35% to 1.2 million by November 2025, with subscribers surpassing 500,000, signaling sticky adoption. Partnerships with major carriers enable seamless data offloading, turning idle spectrum into revenue-generating assets.

Helium’s real-world traction proves DePIN can deliver carrier-grade performance at fractional costs.

Hotspot growth remains robust, with operators incentivized by MOBILE emissions tied to verifiable proofs-of-coverage. This gamified model drives helium hotspots growth, creating a self-reinforcing loop: more devices online mean higher demand, denser deployments, and amplified data usage.

HNT Burn Rate Surges on Data Credit Demand

Central to this momentum is the HNT burn rate, supercharged by user payments converting to data credits. Annualized revenue reached $18.3 million by November 2025, with average daily burns up 196% to $30,920. Helium Mobile channels 100% of proceeds into HNT destruction via automated buybacks on Jupiter Exchange, enforcing scarcity in a HNT deflationary DePIN paradigm. At $0.9296, each burn incrementally tightens supply, potentially catalyzing price appreciation as adoption scales.

Service providers like Helium Mobile must burn HNT to mint data credits, a mechanism detailed in analyses such as Darshan Gandhi’s Blockcrunch deep dive. This ensures economic alignment: users pay fiat, networks buy and torch HNT, operators earn MOBILE. Result? A 2026 ecosystem where daily burns could exceed prior peaks, mirroring the $50,000 trajectory from October 2025.

Helium (HNT) Price Prediction 2027-2032

Projections based on 2.9M+ user growth, HNT burns, DePIN 5G expansion, and market cycles (2026 baseline avg: ~$1.00)

| Year | Minimum Price | Average Price | Maximum Price | Est. YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.40 | $2.80 | $5.50 | +180% |

| 2028 | $2.50 | $5.20 | $10.00 | +86% |

| 2029 | $4.00 | $9.00 | $17.00 | +73% |

| 2030 | $6.00 | $14.00 | $26.00 | +56% |

| 2031 | $9.00 | $20.00 | $37.00 | +43% |

| 2032 | $13.00 | $28.00 | $52.00 | +40% |

Price Prediction Summary

Helium (HNT) is set for strong appreciation driven by massive user adoption (2.9M+ DAUs), aggressive token burns from $18M+ annualized revenue, and DePIN 5G leadership. Conservative mins reflect bearish market risks; maxes assume bull cycles and regulatory tailwinds, with avg prices compounding at ~60% CAGR to $28 by 2032.

Key Factors Affecting Helium Price

- Helium Mobile user surge to 2.9M+ DAUs fueling data usage and burns

- Burn-and-Mint model with 100% revenue to HNT destruction via automated buybacks

- DePIN 5G network expansion via partnerships and Helium Plus program

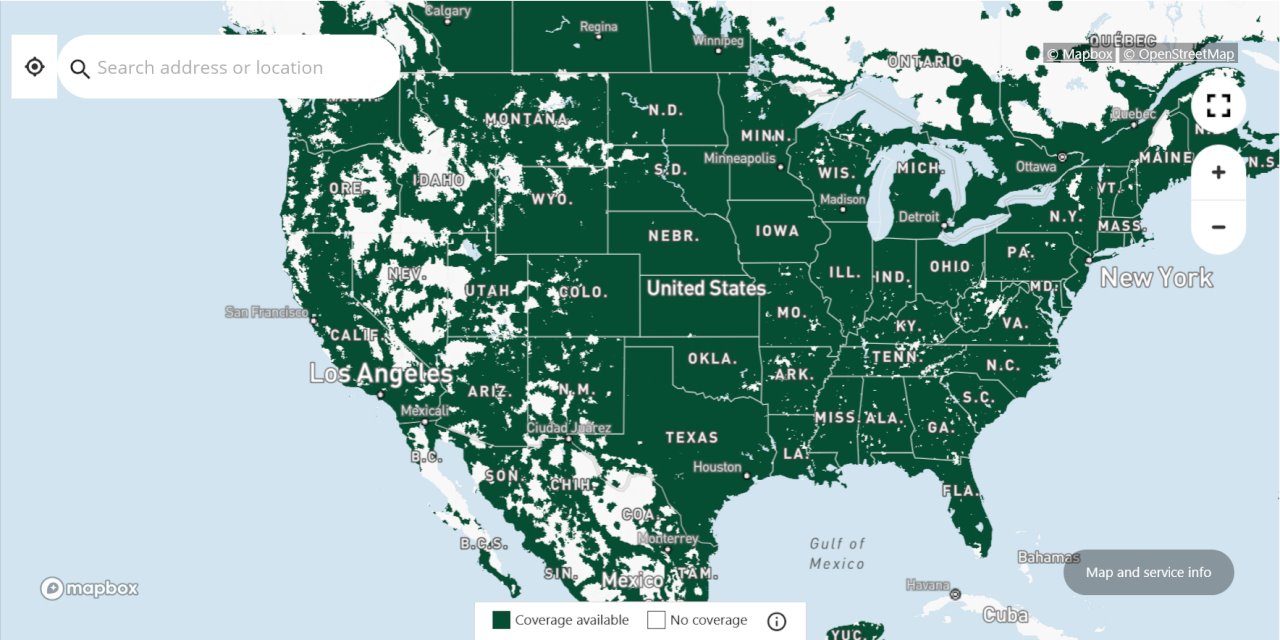

- 113K+ hotspots enabling nationwide coverage and carrier offloading

- Crypto market cycles with potential BTC-led bull runs post-2026

- Regulatory clarity for decentralized networks boosting adoption

- Tech upgrades in hotspots improving uptime and efficiency

- Competition from other DePINs and macro economic factors as risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

DePIN 5G Networks Reshape Telecom Economics

DePIN 5G networks like Helium sidestep billion-dollar tower builds by crowdsourcing infrastructure. With 2.9 million users driving traffic, the network’s proof-of-coverage validates low-cost CBRS deployments, outperforming legacy models in urban density. IoT integration amplifies this, as Helium Plus routers handle hybrid mobile-IoT loads, future-proofing for 5G NR expansions.

Revenue resilience shines through: despite crypto winters, on-chain metrics confirm real usage, not speculative froth. This positions HNT at $0.9296 as undervalued relative to network throughput, inviting investors to bet on continued decentralized wireless 5G 2026 dominance. As burns compound, expect tighter supply dynamics to reward early positioners in this telecom revolution.

For deeper insights into prior growth phases, explore Helium Mobile’s 2 million daily connections and $50K daily HNT burns.

Looking ahead, Helium’s trajectory hinges on sustaining this burn momentum amid scaling challenges. With HNT at $0.9296, the 0.1508% 24-hour uptick signals quiet accumulation, but derivatives traders eye volatility spikes from burn announcements. Options strategies layering calls above $1 could capture upside from projected 2026 burns doubling prior records, leveraging the network’s tokenized incentives.

Quantifying Hotspot Economics in Decentralized Wireless 5G 2026

Helium hotspots growth accelerates as operators deploy CBRS radios optimized for urban canyons and suburban sprawl. Proof-of-coverage protocols, powered by Solana’s high-throughput ledger, validate signals with cryptographic precision, ensuring rewards reflect genuine utility. At scale, 113,891 hotspots handle 2.9 million helium mobile users, processing terabytes daily while burning HNT equivalent to network fees. This creates a flywheel: denser coverage attracts more subscribers, inflating data credits demand and HNT burn rate.

Technical metrics reveal efficiency gains. Average uptime exceeds 95%, with location-weighted MOBILE emissions favoring high-demand zones. IoT payloads from Helium Plus integrations add layered revenue, blending 5G mobile with low-power sensors. Investors should monitor velocity metrics: data credit turnover now outpaces emissions, tilting toward deflation.

Helium Mobile Metrics: HNT Daily Burns, DAUs, Hotspots (2025–Feb 2026) w/ % Growth & $0.9296 Impact

| Period | DAUs (M) | Hotspots | Daily Burn Value ($) | Daily HNT Burns (@ $0.9296) | DAU % Growth¹ | Hotspot % Growth¹ | Burn % Growth¹ |

|---|---|---|---|---|---|---|---|

| Jan 2025 | 0.25 | 80,000 | $10,000 | 10,760 | — | — | — |

| Oct 2025 | 1.2 | 113,891 | $50,000 | 53,803 | +380% | +42% | +400% |

| Dec 2025 | 2.5 | 130,000 | $70,000 | 75,324 | +900% | +63% | +600% |

| Feb 2026 | 2.9 | 150,000 | $90,000 | 96,826 | +1,060% | +88% | +800% |

These figures, drawn from on-chain dashboards, underscore DePIN 5G networks‘ edge over centralized rivals. Traditional telcos face $1 billion and capex for equivalent coverage; Helium leverages underutilized spectrum via blockchain oracles, slashing costs by 90%.

Strategic Plays for HNT Deflationary DePIN Exposure

In a HNT deflationary DePIN landscape, positioning demands nuance. Automated Jupiter buybacks enforce burns regardless of fiat inflows, insulating from crypto downturns. Yet, regulatory scrutiny on CBRS spectrum sharing looms, potentially capping expansion. My take: pair spot HNT at $0.9296 with structured products hedging FCC delays, targeting 2x leverage on burn milestones.

DePIN isn’t hype; it’s programmable infrastructure rewriting telecom ledgers.

Forward curves suggest $0.9296 undervalues 2026 projections: 4 million DAUs could burn $100,000 daily, halving supply inflation. Helium Mobile’s carrier offloads, now routine, embed DePIN into legacy stacks, accelerating mainstreaming.

Operators thrive on this model, earning MOBILE for proofs while HNT scarcity builds value accrual. As decentralized wireless 5G 2026 unfolds, Helium stands as the benchmark, proving crowdsourced networks deliver resilient, scalable connectivity. Stakeholders from hotspot hosts to token holders ride this wave, reshaping wireless economics one verified signal at a time.

Track ongoing evolution via Helium network growth tracking.