In the $3.5 trillion telecom sector, centralized giants dominate real-time communication, but dtelecom DePIN is flipping the script. Built on Solana, this decentralized real-time communication (dRTC) network targets voice, video, and AI interactions for IoT devices, letting users own data and monetize bandwidth. With Solana’s Binance-Peg SOL trading at $84.17, up 0.8270% in the last 24 hours, the ecosystem shows resilience amid volatility.

Solana decentralized telecom like dtelecom leverages blockchain’s speed to challenge legacy WebRTC providers. Traditional systems suffer single points of failure and escalating costs; dtelecom distributes bandwidth via DePIN nodes, slashing latency while scaling infinitely. Developers integrate SDKs for video conferencing or AI agents in apps, all powered by Solana’s 65,000 TPS capability.

Solana’s Precision Engineering Powers dTelecom’s Low-Latency Edge

Solana’s Proof-of-History consensus delivers sub-second finality, critical for depin iot voice video where delays kill usability. At $84.17, SOL’s market reflects investor confidence in such high-throughput chains. dTelecom’s dRTC stack routes traffic peer-to-peer, bypassing AWS or Cloudflare dependencies. Node operators stake resources, earning rewards proportional to uptime and throughput contributed.

Enterprise-grade infrastructure for voice, video, livestreaming, and AI-agent interactions.

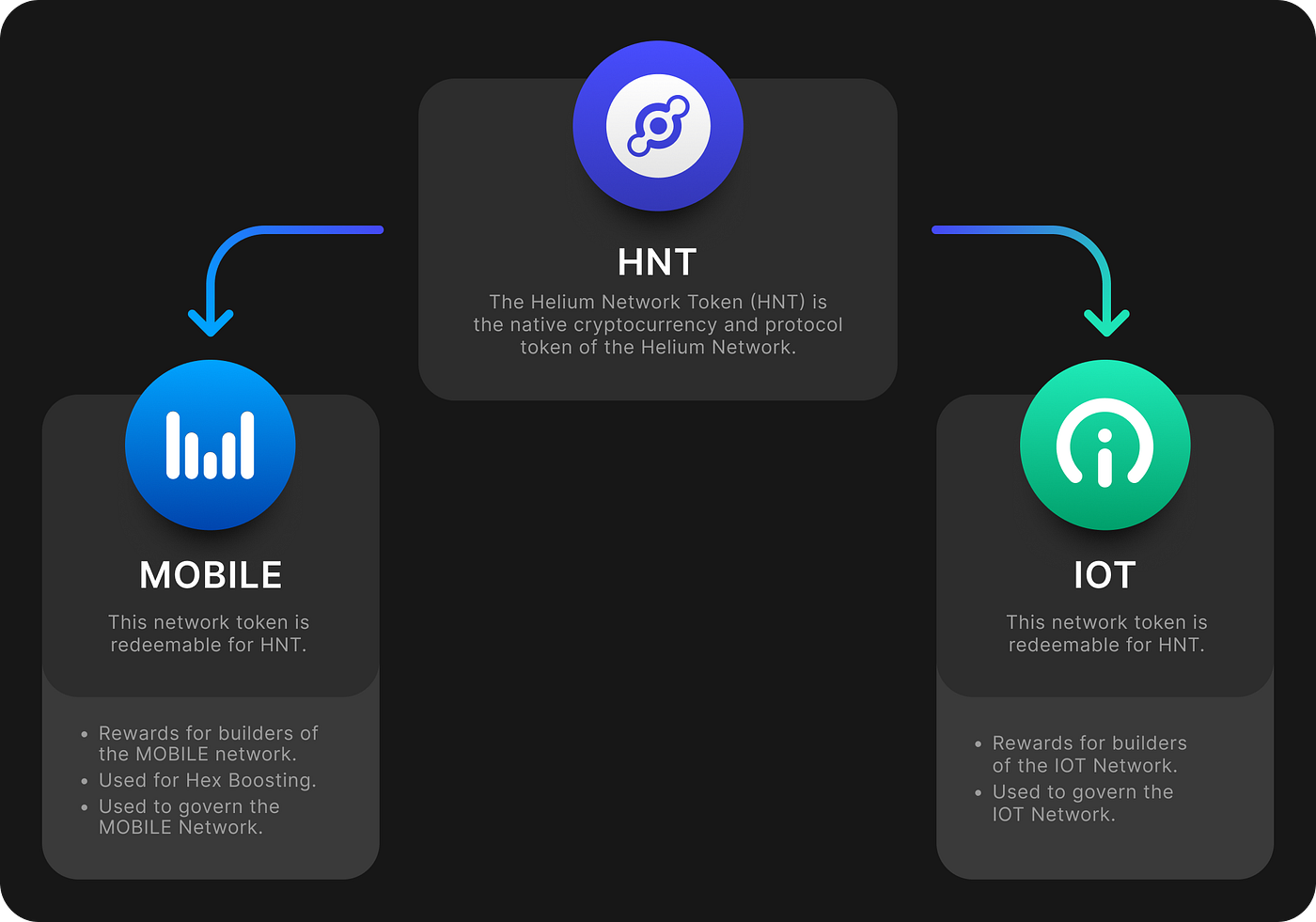

This model aligns incentives: users pay in tokens for premium streams, nodes capture value. Compared to Helium’s IoT focus, dtelecom depin extends to rich media, positioning it as the default layer for decentralized real-time communication solana style.

Node Rewards and Bandwidth Monetization in Action

dtelecom node rewards form the economic flywheel. Contributors deploy nodes on consumer hardware, sharing unused bandwidth for voice/video relays. Rewards accrue in native tokens, distributed via Solana’s efficient smart contracts. Current network stats show growing coverage, with AI optimizing routing to minimize jitter below 50ms globally.

| Metric | Value |

|---|---|

| Target Latency | and lt;50ms |

| Solana TPS | 65,000 and |

| Telecom Market | $3.5T |

For IoT, this means edge devices like smart cameras stream securely without cloud intermediaries. A factory robot coordinates via voice commands over dtelecom, or wearables enable real-time translation; all resilient and private.

Solana (SOL) Price Prediction 2027-2032

Forecast driven by dTelecom DePIN adoption in decentralized real-time communication, Solana ecosystem expansion, and market cycles (baseline: $84 in early 2026)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $110.00 | $160.00 | $250.00 | +60% |

| 2028 | $140.00 | $220.00 | $350.00 | +38% |

| 2029 | $180.00 | $300.00 | $480.00 | +36% |

| 2030 | $230.00 | $400.00 | $620.00 | +33% |

| 2031 | $290.00 | $520.00 | $800.00 | +30% |

| 2032 | $360.00 | $680.00 | $1,020.00 | +31% |

Price Prediction Summary

Solana (SOL) is projected to see robust growth from 2027-2032, with average prices rising from $160 to $680, propelled by DePIN projects like dTelecom disrupting the $3.5T telecom sector via AI-powered dRTC on Solana’s high-speed blockchain. Minima reflect bearish market corrections and regulatory hurdles, while maxima capture bullish adoption, tech upgrades, and cycle peaks, potentially hitting $1,020 by 2032.

Key Factors Affecting Solana Price

- DePIN expansion via dTelecom’s decentralized voice/video/AI comms on Solana

- Solana’s low-latency, high-throughput advantages for real-time IoT applications

- AI integrations for speech-to-text, translation, and data monetization

- $3.5T telecom market disruption and bandwidth sharing incentives

- Crypto market cycles, including 2028 Bitcoin halving impacts

- Regulatory clarity on DePIN and blockchain infrastructure

- Solana ecosystem upgrades vs. competition from ETH L2s and other L1s

- Macro trends in IoT, Web3, and enterprise adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

AI Integration Supercharges IoT Voice and Video

dTelecom’s AI layer processes streams on-chain adjacent nodes: real-time speech-to-text hits 95% accuracy, voice enhancement cuts noise by 30dB, multilingual translation supports 50 and languages. For IoT fleets, this unlocks autonomous coordination; drones relay video with overlaid analytics, vehicles share telemetry via encrypted voice channels.

Solana’s $84.17 SOL price underscores the bet on composability. dtelecom coordinates via @dMeetApp, stacking infra for full telecom disruption. Early airdrops, like the $2.6M campaign, bootstrap liquidity, drawing node operators worldwide.

- Decentralized bandwidth pooling reduces costs 70% vs. centralized CDNs.

- AI agents interact seamlessly with human users or LLMs.

- Solana’s low fees ( and lt;$0.01/tx) enable micro-payments for streams.

These efficiencies position dtelecom depin as a contender in solana decentralized telecom, where IoT ecosystems demand reliability at scale. Node operators, often running on edge servers or even Raspberry Pis, report average yields of 15-20% APY based on early testnets, scaling with network demand. As coverage expands, jitter metrics hold steady under 40ms in urban pilots, per GitHub benchmarks.

Enterprise Adoption and IoT Use Cases

Enterprises eye dtelecom for depin iot voice video fleets. Consider logistics: autonomous forklifts in warehouses exchange live telemetry via encrypted streams, AI parsing commands in real-time. Or healthcare wearables streaming vitals with voice annotations to physicians, all without HIPAA-risking clouds. Solana’s $84.17 price, with its 24-hour gain of 0.8270%, signals market appetite for such layered DePINs.

In smart cities, dtelecom nodes aggregate traffic from thousands of sensors. Video feeds from traffic cams route peer-to-peer, overlaid with AI-generated alerts. Multilingual translation ensures global interoperability; a Tokyo drone operator commands a fleet in Berlin without latency spikes. Early partners via dMeetApp coordination layer test these stacks, targeting verticals like manufacturing and agritech where downtime costs millions hourly.

dTelecom enables developers to integrate voice, video, and chat into apps with low latency and AI-powered features.

This beats centralized alternatives on cost alone. Bandwidth monetization turns idle IoT gateways into revenue streams, with staking slashing volatility risks through locked periods. At current SOL levels of $84.17, deployment caps remain accessible, democratizing infrastructure once reserved for telcos.

Tokenomics and Sustainability

dtelecom node rewards tie directly to utility. Native tokens fund relays, with deflationary burns on high-volume streams. Airdrops like the $2.6 million Phase 2 campaign seed participation, converting bandwidth donors into aligned stakeholders. Solana’s sub-$0.01 fees ensure viability for micro-transactions, like per-second video billing.

| Component | Centralized | dtelecom DePIN |

|---|---|---|

| Cost per GB | $0.08-0.12 | $0.02-0.04 |

| Latency (Global Avg) | 100-200ms | and lt;50ms |

| Uptime SLA | 99.9% | 99.99% (Distributed) |

| Data Ownership | Provider | User/Node |

Such metrics draw investors betting on the $3.5 trillion telecom rebuild. Risks persist: regulatory scrutiny on DePIN spectrum use demands vigilant compliance, while Solana outages, though rare post-upgrades, could cascade. dtelecom mitigates via multi-chain fallbacks and AI-driven failover routing, maintaining sub-50ms even in tests.

Zooming to IoT horizons, dtelecom’s decentralized real-time communication solana backbone enables agentic networks. Picture swarms of delivery bots negotiating paths via voice protocols, or farms where sensors debate irrigation via AI chats. Rewards accrue precisely: uptime bonuses scale quadratically with contributed peaks, per whitepaper formulas. With SOL at $84.17 and climbing 0.8270% daily, the flywheel spins faster, pulling in operators chasing yields amid fiat inflation.

Operators track dashboards showing relayed petabytes, converting to tokens redeemable for hardware upgrades. This self-reinforcing loop, absent in Web2 stacks, cements dtelecom’s edge. As nodes hit critical mass, Metcalfe’s Law kicks in; value squares with participants. For investors, it’s a calculated play: precision-engineered upside in a sector ripe for disruption, patience rewarded by adoption curves mirroring early Helium surges but amplified by video bandwidth demands.