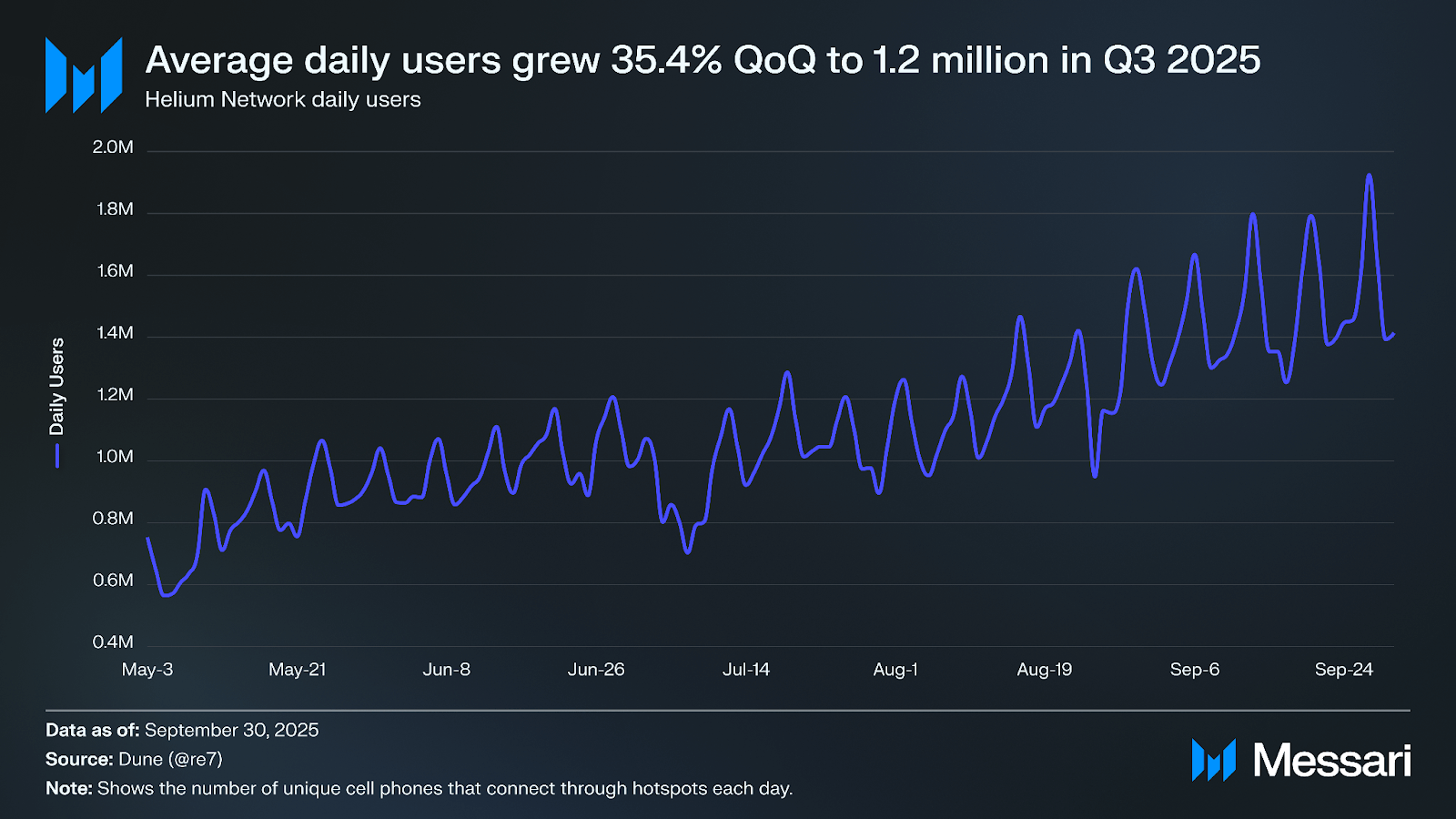

Helium’s decentralized wireless network is delivering results that demand attention from any investor eyeing DePIN wireless growth. With HNT trading at $1.48 as of February 22,2026, the protocol’s fundamentals are outpacing market noise. Q3 2025 saw data offload volumes explode by 100.4% quarter-over-quarter to 5,452 terabytes, fueled by daily users climbing 35.4% to 1.2 million. This isn’t hype; it’s a revenue boom from data transactions reshaping IoT connectivity.

Network activity tells the real story. Helium Mobile has surpassed 500,000 sign-ups, doubling from 250,000 in just six months. IoT data transfer volumes grew 34%, while mobile active users hit 94,000 by January 2026, a 156% year-over-year leap. Hotspots number over 366,000, proving real-world deployment at scale. These metrics signal Helium HNT IoT revenue accelerating, even as broader markets waver.

Dissecting the 100% and Data Offload Surge

At the core of Helium’s network surge lies explosive data usage. Q3 2025’s 5,452 terabytes offloaded represent not just volume, but utility. Daily active users reached 1.2 million, up sharply, as IoT devices and mobile subscribers lean on decentralized coverage. This HNT data transactions boom stems from practical needs: resilient, low-cost connectivity in dense urban areas where traditional towers falter.

Consider the numbers. Average daily Data Credit burns jumped 196.6% to $30,920, annualizing to $18.3 million in revenue. That’s organic growth from on-chain fees, with DePIN sector totals hitting $150 million in January 2026. Helium hotspots drive this, outmaneuvering legacy infrastructure by incentivizing community deployment. Investors should note: this scales without centralized capex burdens.

Helium isn’t just a token; it’s a functioning DePIN network with 366K and hotspots and real mobile subscribers.

Yet, prudence dictates scrutiny. While surges impress, sustainability hinges on retention. Helium Mobile’s subscriber revenue now flows into open-market HNT, bolstering buy pressure. Daily connections nearing 2 million underscore momentum in decentralized IoT 5G.

Burn-and-Mint Equilibrium: Tokenomics Powering Value Accrual

Helium’s Burn-and-Mint mechanism is the strategic linchpin. Users burn HNT for Data Credits to access the network, creating deflationary pressure as burns exceed emissions. This equilibrium has tokenized real utility, with Q3 burns doubling monthly peaks. At $1.48, HNT captures this flywheel: more data transactions mean more burns, tighter supply, potential upside.

Strategic here means measured. Unlike speculative narratives, Helium ties token value to throughput. Integrations with AT and T and T-Mobile enable seamless offloading, expanding coverage without proprietary builds. Result? Zero-plan users now face fees, signaling maturation from giveaway to monetized service. DePIN wireless growth demands such evolution.

Explore Helium’s real-world metrics.

Portfolio managers like myself prioritize protocols where revenue compounds. Helium enters 2026 with sustainable organic growth, subscribers over 600,000, and daily users pushing limits. This positions HNT favorably amid IoT acceleration.

Partnerships and Adoption: Catalysts for Helium DePIN Expansion

Telecom giants validate Helium’s model. AT and T and T-Mobile integrations have turbocharged data flows, with offloads proving the network’s reliability. Helium hotspots vs. traditional 5G towers offer cost-efficient coverage for IoT in challenging terrains. This isn’t theoretical; it’s 1.92 million daily phone connections boosting U. S. telco coverage.

From IoT dreams to mobile reality, Helium redefines decentralized wireless. Network revenue from fees hits $1.7 million monthly across WiFi and IoT, per recent deployments. As global IoT surges, Helium stands at the crossroads, blending blockchain with physical infrastructure.

Opinion: Patience rewards here. While HNT dipped slightly -0.67% in 24 hours to $1.48, underlying metrics scream undervaluation. Forward projections hinge on continued execution.

Helium (HNT) Price Prediction 2027-2032

Projections based on DePIN network expansion, IoT revenue growth, subscriber surges, and token burn mechanics amid crypto market cycles

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $2.00 | $4.50 | $8.00 | +200% |

| 2028 | $3.50 | $7.20 | $12.50 | +60% |

| 2029 | $5.00 | $10.50 | $18.00 | +46% |

| 2030 | $7.00 | $15.00 | $25.00 | +43% |

| 2031 | $10.00 | $21.00 | $35.00 | +40% |

| 2032 | $14.00 | $28.00 | $45.00 | +33% |

Price Prediction Summary

Helium (HNT) is forecasted to experience robust growth from 2027-2032, with average prices climbing from $4.50 to $28.00, driven by network revenue booms, subscriber growth exceeding 600K, data credit burns creating deflationary pressure, and DePIN/IoT adoption. Minimums reflect bearish scenarios like regulatory hurdles or market downturns; maximums capture bullish cycles, telecom partnerships (e.g., AT&T, T-Mobile), and tech advancements. Overall CAGR ~44%, positioning HNT for 10-20x returns from current $1.48 levels.

Key Factors Affecting Helium Price

- Explosive network growth: 80% surge in data transactions, Q3 2025 data offload +100% QoQ to 5,452 TB

- Subscriber boom: 500K+ Helium Mobile sign-ups, 94K active users (+156% YoY), 1.2M daily users

- Deflationary tokenomics: HNT burns outpacing emissions via Burn-and-Mint, $18.3M annualized revenue

- Strategic integrations: AT&T, T-Mobile partnerships enhancing coverage and data offloading

- DePIN sector momentum: $150M Jan 2026 revenue, IoT/mobile use cases expanding

- Market cycles: Potential bull runs post-2024 halving; competition from other DePINs

- Regulatory risks: Favorable wireless regs could boost, but crackdowns may cap growth

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Predictions underscore a compelling case, with analysts forecasting HNT appreciation tied to sustained DePIN wireless growth. At current levels around $1.48, even modest network expansion could yield substantial returns for patient allocators.

Quantifying Helium’s Revenue Engine: Metrics That Matter

Helium HNT IoT revenue hinges on tangible throughput. Data transactions, once nascent, now form the backbone of value accrual. Q3 2025 metrics reveal a protocol firing on all cylinders: data offload doubled, user bases expanded, and burns accelerated. This 80% network surge, building on prior quarters, stems from IoT devices demanding reliable, decentralized coverage amid 5G rollout lags.

Helium Q3 2025 vs Q2 Key Metrics

| Metric | Q3 2025 | QoQ Change |

|---|---|---|

| Data Offload | 5,452 TB | 100.4% ↑ |

| Daily Users | 1.2M | 35.4% ↑ |

| DC Burns (Daily) | $30,920 | 196.6% ↑ |

| Annual Revenue | $18.3M | N/A |

These benchmarks position Helium ahead of DePIN peers. Hotspots, exceeding 366,000, generate $1.7 million monthly fees across WiFi and IoT streams. Mobile subscribers, now over 600,000 with daily actives nearing 2 million, convert usage into HNT burns. Strategic insight: focus on burn rates exceeding emissions signals supply discipline rare in crypto.

Dive into hotspot fee dynamics.

Integrations amplify this. AT and amp;T and T-Mobile offloads validate interoperability, routing terabytes through community infrastructure. Helium hotspots outperform traditional 5G towers in dense zones, slashing costs for IoT deployments. Result? Telecoms tap decentralized capacity, funneling revenue back to HNT holders.

Risk-Adjusted Outlook: Prudence in DePIN Wireless Growth

My two decades managing portfolios emphasize balance. Helium’s 24-hour dip of -0.67% to $1.48 tests resolve, yet fundamentals hold firm. Mobile sign-ups doubling to 500,000-plus reflect viral adoption, but execution risks loom: carrier dependencies, regulatory scrutiny on spectrum, competition from centralized 5G.

Counterpoint: Burn-and-mint fortifies resilience. With burns outpacing emissions, tokenomics embed deflation. Organic revenue, annualized at $18.3 million and climbing, funds network security via veHNT staking. Investors should allocate judiciously, targeting 5-10% portfolio weight, diversified across DePIN assets.

Track ongoing network metrics.

Forward, IoT acceleration globally catapults Helium. Projections eye 2026 data volumes tripling as smart cities deploy sensors en masse. Helium Mobile’s evolution from free tiers to fee-based plans matures the model, channeling subscriber revenue into open-market HNT buys. Daily connections at 1.92 million for U. S. telcos hint at scalable 5G augmentation.

Strategic portfolios thrive on such asymmetries. Helium bridges blockchain utility with physical demand, undervalued at $1.48. As DePIN narratives solidify, HNT data transactions will propel not just price, but sector legitimacy. Monitor burns weekly; scale positions on sustained upticks. Patience and prudence fuel performance here.