As of December 7,2025, Helium Mobile has shattered expectations by surpassing 2 million daily connections, a milestone that signals the explosive adoption of DePIN 5G hotspots in the wireless world. With HNT trading at $1.91, down 1.55% over the last 24 hours, the network’s momentum shows no signs of slowing. This surge in Helium Mobile daily users isn’t just numbers on a dashboard; it’s proof that blockchain-powered wireless is slashing telecom costs and redefining connectivity for millions.

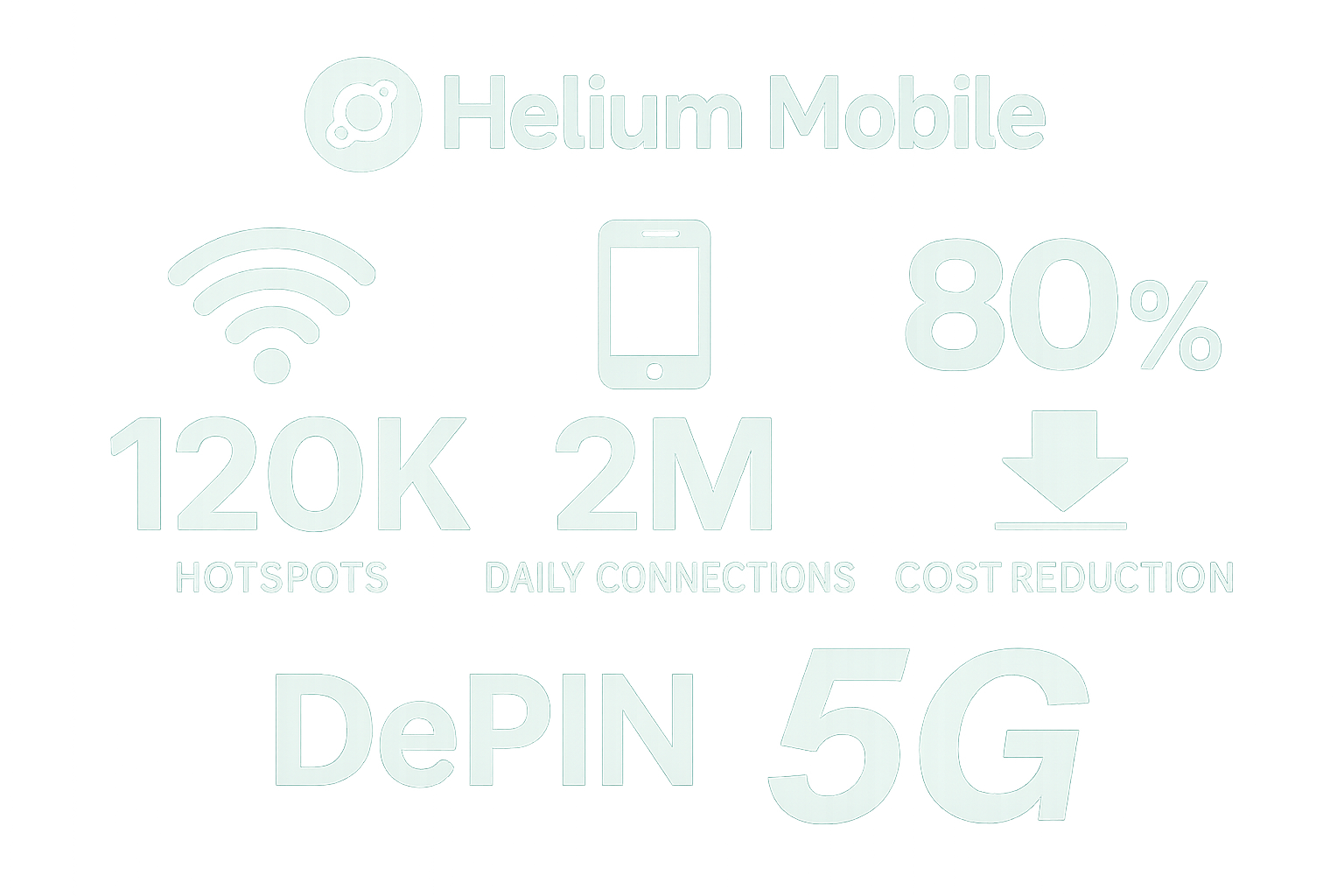

Helium’s growth trajectory in 2025 has been nothing short of remarkable. Daily active users peaked near 2 million, with Helium Mobile handling 1.92 million phone connections and burning around $50,000 worth of HNT daily from subscriber revenue. In November alone, the network hit new all-time highs: over 2 million phones connected, daily data transfer exceeding 77,000 TB, and total mobile hotspots reaching 120,000 and. Q2 saw a cumulative 2,721 TB of data offloaded from major U. S. carriers, a 138.5% quarter-over-quarter jump that eased congestion on legacy networks.

Network Expansion Through Community Hotspots

The backbone of this expansion lies in Helium’s DePIN 5G hotspots, now numbering over 113,891 and climbing toward 120,000. These community-deployed nodes have driven $1.7 million in monthly fees across DePIN WiFi and IoT, with IoT hotspots nearing 1 million units and deployment surging 227% year-to-date. Data usage hit 20.47 TB monthly, while paid data traffic surpassed 2,557 TB. Hotspot hosts earned over $300,000 in offload rewards in June 2025 alone, incentivizing more deployments and creating a self-sustaining loop of coverage and earnings.

This model flips the script on traditional telecom. Instead of billion-dollar cell towers, individuals and businesses deploy affordable hotspots, earning HNT rewards while offloading traffic. Average daily Data Credit burns rose from $6,170 to $10,423, reflecting heightened usage. On August 18,2025, Helium committed to burning 100% of Mobile subscriber revenue in HNT, directly tying network economics to token scarcity and value accrual.

Strategic Partnerships Accelerating Adoption

Helium’s leap to Helium network 2 million connections owes much to high-profile collaborations. In February 2025, Telefónica’s Movistar integrated the Helium Network for over 2 million subscribers in Mexico, deploying hotspots across 300 and sites to offload data and cut costs. Fast-forward to April, and AT and T tapped into Helium’s user-powered WiFi hotspots, bolstering U. S. coverage without massive capex. These moves validate decentralized wireless as a viable alternative for telcos facing skyrocketing 5G demands.

Helium Mobile now boasts over 2 million subscribers, up from 500,000 sign-ups earlier in the year, serving 1.2 million daily users through its vast hotspot ecosystem. This isn’t hype; it’s real-world utility powering decentralized 5G subscribers and IoT at scale.

Slashing Telecom Costs with DePIN Innovation

At its core, Helium disrupts by delivering an 80% reduction in operational costs versus legacy networks. Traditional telcos pour billions into towers, but DePIN shifts that burden to incentivized communities. Q3 2025 data from Messari highlights how HNT burns from subscriber revenue fueled growth, with hotspots driving substantial offload volumes.

Helium (HNT) Price Prediction 2026-2030

Projections based on DePIN growth, 2M+ daily connections, telecom partnerships (AT&T, Telefónica), token burns, and network expansion disrupting traditional telecom costs

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $2.20 | $4.50 | $8.50 |

| 2027 | $3.50 | $7.00 | $13.00 |

| 2028 | $5.00 | $10.50 | $19.00 |

| 2029 | $7.20 | $14.50 | $26.00 |

| 2030 | $10.00 | $19.00 | $32.00 |

Price Prediction Summary

Helium (HNT) is forecasted to experience substantial growth from its current $1.91 price, driven by surging adoption (2M+ daily connections), aggressive HNT burns from mobile revenue ($50K+ monthly), and major partnerships reducing telecom costs by up to 80%. Minimum prices reflect bearish market cycles or regulatory hurdles; averages assume steady DePIN expansion; maximums capture bull runs with 10x+ network growth. Overall CAGR ~60% through 2030, targeting $5-10B market cap.

Key Factors Affecting Helium Price

- Explosive network growth: 2M+ daily connections, 77k+ TB daily data transfer, 120k+ hotspots

- Token burns: 100% of subscriber revenue burned (e.g., $50K HNT monthly), enhancing scarcity

- Strategic partnerships: AT&T (US Wi-Fi offload), Telefónica Movistar (Mexico 2M+ subscribers)

- DePIN disruption: 80% telecom cost reduction, 2,721+ TB quarterly data offload

- Market cycles: Bullish crypto trends post-2025 halving; bearish risks from regulation/competition

- Tech advancements: 5G hotspots, IoT expansion, community rewards ($300K+ monthly)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Consider the numbers: Helium offloaded 2,721 TB in Q2, peaking at 77,000 TB daily transfers. This alleviates carrier strain, improves reliability, and opens doors for blockchain wireless 2025 applications in dense urban areas and IoT deployments. As HNT hovers at $1.91, these fundamentals suggest sustained upside for investors eyeing telecom transformation.

Dive deeper into daily connections impact.

Looking ahead, Helium’s tokenomics reinforce this momentum. The August 18 commitment to burn 100% of Helium Mobile subscriber revenue in HNT has already torched tens of thousands daily, tightening supply as demand from HNT token burns telecom economics ramps up. With average daily Data Credit burns climbing to $10,423, the network’s utility is locking in value for holders. This isn’t speculative fluff; it’s a mechanism that aligns community incentives with real revenue, something traditional telcos can only dream of.

Hotspots vs. Towers: A Cost Revolution in Action

Deploying a Helium hotspot costs under $500, versus millions for a single cell tower. This democratizes infrastructure, especially for DePIN 5G hotspots in underserved spots. In dense urban zones, where legacy networks buckle under IoT loads, Helium’s resilient coverage shines. Data from Q3 underscores this: IoT hotspots approach 1 million, with paid traffic over 2,557 TB monthly. Hosts pocketed $300,000 in June rewards alone, fueling a 227% year-to-date deployment spike.

As an IoT strategist who’s tracked these shifts for years, I see Helium not just competing, but redefining scalability. Telcos like AT and amp;T and Movistar aren’t partnering out of charity; they’re slashing capex by offloading to a network that grows organically. By December 2025, with HNT at $1.91, the math favors early participants who staked hotspots early.

Compare hotspot economics to tower costs

Metrics That Matter: Helium’s 2025 Snapshot

Helium Mobile Growth Metrics: Q2 2025 vs. November Peak 📈

| Metric | Q2 2025 | November Peak |

|---|---|---|

| Daily Connections 📈 | 1.92M | 2M+ |

| Hotspots 📈 | 113K | 120K+ |

| Data Offload 📈 | 2,721 TB | 77K TB/day |

| HNT Burns (Daily) 🔥 | $6K-$10K | $50K |

| Monthly Rewards | $1.7M fees | N/A |

These figures paint a clear picture of acceleration. Helium Mobile’s 2 million daily users aren’t passive; they’re streaming, connecting IoT devices, and offloading gigabytes that would otherwise clog carrier pipes. Peak data transfers at 77,000 TB daily highlight capacity no centralized rival matches without fresh billions in spend.

Community sentiment echoes this. Helium CEO Amir Haleem’s updates on X underscore relentless execution, from Mexico’s 300-site rollout to U. S. WiFi integrations. Investors should note how these partnerships de-risk the model, blending DePIN purity with enterprise scale.

Investment Angle: Why HNT at $1.91 Signals Opportunity

At $1.91, down slightly from a 24-hour high of $1.99, HNT trades at a fraction of its utility potential. With subscriber revenue fully burned, every connection accretes value. Sarson Funds calls it “exceptional growth, ” peaking near 2 million daily actives. For those eyeing decentralized 5G subscribers, Helium offers exposure to a $1 trillion telecom market ripe for disruption.

Picture this: as 5G-IoT fusion hits stride in 2026, Helium’s 120,000 hotspots position it as the go-to offload layer. Early data shows 80% cost savings translating to telco margins juiced by DePIN. I’ve modeled similar integrations in quant finance; the compounding from burns and adoption points to multi-bagger upside, grounded in terabytes transferred, not vaporware.

Helium Mobile’s 2 million milestone cements DePIN as telecom’s future backbone. Community hotspots, strategic tie-ups, and ironclad tokenomics are forging a wireless world where coverage expands with users, not capex. With HNT steady at $1.91, the network’s real traction invites builders, hosts, and investors to plug in now, before the next data surge redefines the map.