In the high-stakes arena of wireless connectivity, AT and T’s towering 5G infrastructure stands as a monument to centralized ambition, blanketing urban centers with high-speed signals while leaving rural expanses in the shadows. Enter Helium hotspots, nimble devices costing as little as $249 that ordinary individuals deploy as “mini cell towers, ” fueled by blockchain incentives and now intertwined with AT and T’s network. With Helium’s HNT token trading at $0.8232, up a modest $0.005040 or and 0.006170% over the past 24 hours, this decentralized model challenges the telecom giant’s dominance by turning users into operators and fixed costs into tokenized rewards.

AT and T’s Capital-Intensive 5G Fortress

AT and T has invested billions erecting 5G towers, each a behemoth requiring land leases, regulatory approvals, and maintenance crews. These structures deliver blazing speeds in dense areas, but coverage thins dramatically beyond city limits. The economics are unforgiving: a single tower can cost $300,000 to deploy and millions annually to operate, pricing out expansion into low-density regions. This leaves decentralized wireless networks like Helium to fill the voids, where traditional players deem returns insufficient.

Yet AT and T’s model excels in reliability and spectrum control, leveraging licensed bands for consistent performance. Still, as 3G sunsets loom, IoT users face pressure to upgrade, highlighting gaps where network costs balloon for fragmented deployments. Helium counters this with negligible operational expenses for large device fleets, as noted by industry voices emphasizing LoRa and similar low-power protocols.

Helium Hotspots: Tokenized Incentives Reshape Coverage

Helium flips the script through its DePIN architecture, where anyone purchases a hotspot for $249-$499 and becomes a micro-operator. These devices provide Wi-Fi and cellular offload, earning helium hotspots incentives like $0.50 per gigabyte transmitted – a stable rate decoupled from HNT’s volatility at $0.8232. Operators also receive HNT tokens for coverage and data relay, creating a flywheel: more hotspots mean broader DePIN 5G coverage, attracting users and boosting rewards.

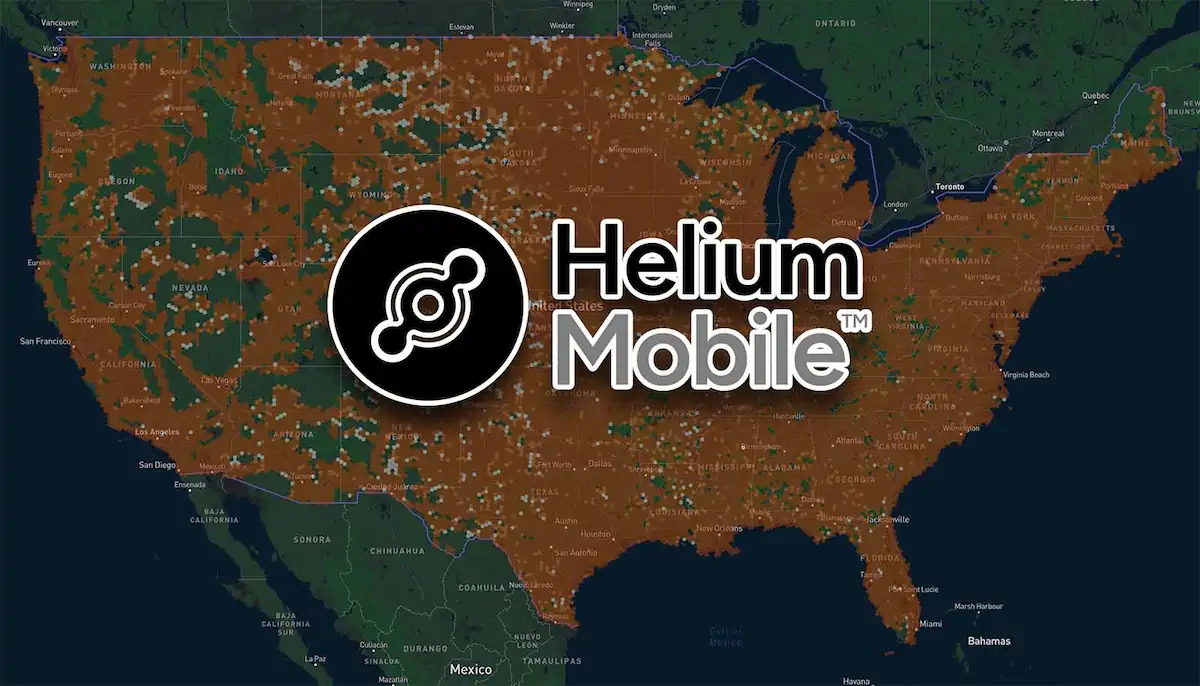

This blockchain hotspot rewards system has scaled to over 93,500 U. S. hotspots, subsidizing free plans that draw 2,000 daily users at $10-$15 acquisition costs. Unlike AT and T’s top-down buildout, Helium’s bottom-up growth thrives on community participation, offering $20/month unlimited plans that undercut traditional carriers. Data from Q3 2025 underscores this: incentives drive deployment, turning individuals into stakeholders vested in network health.

Collision Course: AT and T Embraces Helium’s DePIN Model

In a pivotal April 2025 move, AT and T enabled roaming onto Helium’s Wi-Fi hotspots for its subscribers, integrating over 93,500 community nodes. This partnership validates helium vs AT and T 5G dynamics, blending centralized scale with decentralized density to tackle underserved areas. AT and T customers now auto-connect, slashing its capex while hotspot owners pocket HNT rewards at $0.8232 per token.

Helium Mobile’s DC burn surged 91% amid this alliance, signaling robust token utility as data flows increase. Operators benefit from steady $0.50/GB payouts alongside HNT, fostering stability rare in crypto-driven networks. For AT and T, it’s a low-risk coverage booster; for Helium, mainstream credibility accelerates adoption toward 1 million users.

Helium (HNT) Price Prediction 2027-2032

Forecasts based on AT&T partnership expansion, DePIN adoption, and current 2026 price of $0.82 amid bullish network growth trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $1.20 | $2.50 | $4.50 | +204% |

| 2028 | $2.00 | $4.00 | $7.00 | +60% |

| 2029 | $3.00 | $6.00 | $10.00 | +50% |

| 2030 | $4.50 | $9.00 | $15.00 | +50% |

| 2031 | $6.00 | $12.00 | $20.00 | +33% |

| 2032 | $8.00 | $16.00 | $25.00 | +33% |

Price Prediction Summary

HNT is forecasted for strong growth through 2032, driven by AT&T roaming integration, hotspot proliferation, and DePIN validation. Average prices could rise from $2.50 in 2027 to $16 by 2032 in base scenarios, with maxima reflecting bull market peaks and minima accounting for bearish cycles or regulatory hurdles.

Key Factors Affecting Helium Price

- AT&T partnership enabling Wi-Fi roaming on 93,500+ hotspots, boosting adoption and DC burns

- Stable $0.50/GB data rewards independent of HNT price, ensuring miner incentives

- DePIN model scalability reducing telecom costs, targeting 1M+ users

- Crypto market cycles with potential 2028-2029 bull run post-regulatory clarity

- Competition from XNET/Karrier One and tech upgrades like Wi-Fi 6+

- Network expansion to underserved areas and IoT use cases driving demand

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Helium’s partnership with AT and T not only bridges coverage gaps but also exposes the raw economics pitting decentralized wireless networks against legacy infrastructure. Traditional towers demand upfront capital that scales linearly with geography; Helium hotspots multiply exponentially through incentives, where each new device at $249 enhances the entire mesh.

Head-to-Head Metrics: Cost, Scale, and Rewards

Quantifying helium vs AT and T 5G reveals stark divergences. AT and T’s towers average $300,000 per unit with ongoing leases pushing lifetime costs past $1 million. Helium shifts this burden: a $249 hotspot yields returns via stable $0.50 per GB transmitted, plus HNT at $0.8232 for proof-of-coverage. Network effects amplify earnings as user density rises, with Q3 2025 data showing deployments surging on tokenized rewards.

Helium Hotspot vs. AT&T 5G Tower Comparison

| Deployment Cost | OpEx/Year | Coverage Area | Incentives | Scalability |

|---|---|---|---|---|

| $249-$499 | Low/Negligible | Global (93,500+ hotspots) | $0.50/GB + HNT ($0.8232) rewards | Exponential 🚀 |

| $300,000 | High (millions) | Urban-focused | None | Linear |

This table underscores Helium’s edge in low-barrier entry and variable costs, ideal for DePIN 5G coverage. AT and T excels in peak throughput via licensed spectrum, yet struggles with rural economics; Helium thrives there, subsidizing plans that hook 2,000 users daily toward a 1 million target.

Operator Economics: Why Micro-Operators Win

Helium transforms passive users into active earners. Deploy a hotspot, earn $0.50/GB independent of HNT’s $0.8232 price, plus tokens for uptime and data relay. This dual reward – fiat-stable data credits alongside crypto upside – buffered a 91% DC burn surge post-AT and T tie-up. Operators report negligible costs for IoT fleets, contrasting AT and T’s ballooning expenses for sparse connections.

Key Helium Hotspot Incentives

-

$0.50/GB stable payout for data transmitted, independent of HNT price (Reddit r/HeliumNetwork).

-

HNT rewards at $0.8232 for providing coverage and data transfer.

-

$249 entry cost for hotspot device, enabling anyone to become a micro-operator.

-

Auto-roaming for AT&T users on 93,500+ Helium hotspots nationwide.

-

$20/mo unlimited plans attract users, boosting data demand and rewards.

Such mechanics foster loyalty; micro-operators maintain devices vested in network growth, unlike hired crews. AT and T’s roaming leverages this, offloading traffic to 93,500 and hotspots without fresh capex, a win-win validating DePIN’s hybrid potential.

Global Horizons: From U. S. Roaming to Worldwide Mesh

While AT and T anchors U. S. expansion, Helium eyes planetary scale. Partnerships mirror XNET’s WiFi-6 deployments at $749, but Helium’s LoRa roots suit IoT globally, where 3G phaseouts demand cheap alternatives. Token flywheels propel coverage: more hotspots draw carriers, spiking data credits and HNT utility at $0.8232.

Investors note the asymmetry. AT and T’s fortress yields steady dividends but caps growth; Helium’s HNT, with 24-hour gains of and 0.006170%, ties to usage velocity. As DC burns accelerate and users scale, blockchain hotspot rewards could eclipse traditional opex, reshaping telecom valuations. Data credits’ stability tempers volatility, drawing institutions eyeing DePIN’s trillion-dollar infrastructure pivot.

Helium hotspots prove incentives trump towers for pervasive reach. Operators pocket rewards, carriers cut costs, users gain seamless connectivity – a blueprint where decentralization densifies what centralization dilutes.