As the decentralized wireless sector matures, Helium’s token burn model stands out as a blueprint for sustainable blockchain-powered connectivity. At the heart of this system is the Helium Network Token (HNT), currently priced at $2.64. The HNT tokenomics have evolved to address both network scalability and long-term value, creating a rare alignment between infrastructure growth and token scarcity. Today, Helium’s approach isn’t just theoretical – it’s actively burning millions in monthly network revenue, setting the stage for a deflationary 5G ecosystem that rewards both users and operators.

The Burn-and-Mint Equilibrium: Engine of Decentralized Wireless Tokenomics

Helium’s Burn-and-Mint Equilibrium (BME) is more than economic jargon – it’s an elegant mechanism directly tying network usage to HNT supply. When users send data over Helium’s 5G or IoT networks, they pay with Data Credits (DCs). Here’s where things get interesting: DCs aren’t bought on exchanges. Instead, they’re created by burning HNT at a fixed rate (1 DC = $0.00001 USD), permanently removing those tokens from circulation.

This means every byte of data transmitted literally shrinks the available HNT supply. As adoption grows – whether from IoT sensors or 5G mobile subscribers – more HNT is burned, introducing a powerful deflationary pressure that could benefit long-term holders. Recent reports confirm that Helium burns over $2.3M in HNT monthly from Helium Mobile revenues, demonstrating real-world demand driving token scarcity.

Data Credits: The Utility Backbone of Blockchain-Powered Wireless Networks

Data Credits (DCs) are pivotal in transforming abstract blockchain economics into tangible wireless utility. Pegged to the US dollar for price stability, DCs are non-transferable and can only be acquired by burning HNT. This design ensures there’s no speculation on DCs themselves; their sole purpose is to pay for network access – whether moving sensor data across an IoT subnetwork or streaming video over decentralized 5G.

This dynamic creates a self-sustaining loop: As demand for wireless coverage increases, more users burn HNT for DCs, which funds network expansion and incentivizes new hotspot deployment. The model elegantly sidesteps common pitfalls in crypto utility tokens by making demand inseparable from real-world usage.

The Role of SubDAO Tokens: Incentivizing Targeted Growth Across DePIN 5G and IoT

The introduction of subnetwork tokens like IOT and MOBILE has been pivotal in refining incentives across Helium’s multi-layered architecture. Operators deploying 5G hotspots earn MOBILE tokens, while those supporting IoT connectivity receive IOT tokens. These sub-tokens can be swapped into HNT – which can then be burned for Data Credits or staked for governance via veHNT – creating interoperability between usage incentives and core economic health.

This modular approach not only drives targeted growth within each segment but also aligns operator rewards with overall network performance and token scarcity dynamics.

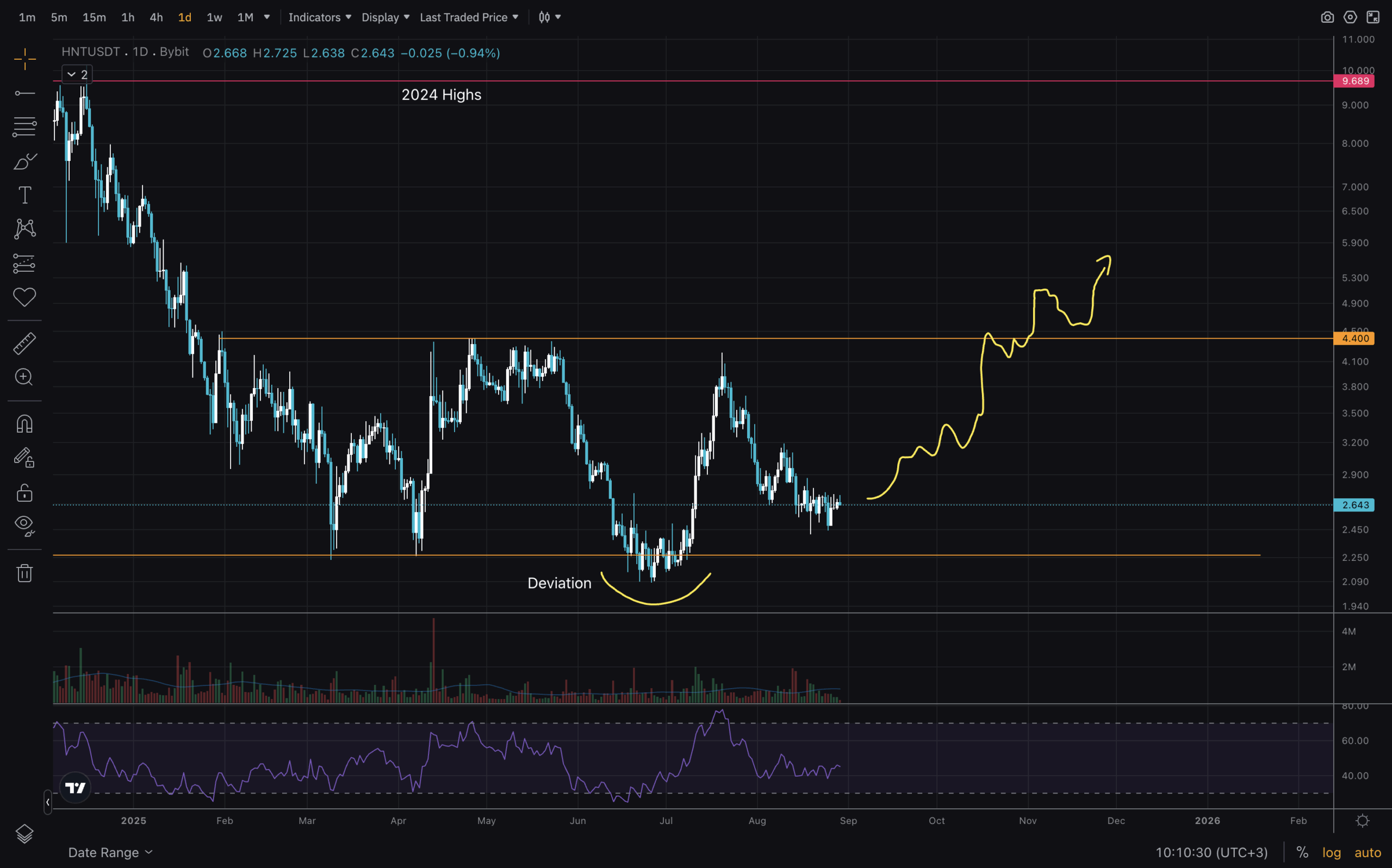

Helium (HNT) Price Prediction 2026-2031

Professional forecast based on Helium’s deflationary tokenomics, market cycles, and adoption trends. All figures in USD per HNT token.

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $2.10 | $3.20 | $5.00 | +21% | Post-halving deflationary impact begins; increased DC demand as 5G and IoT adoption rises. Volatility expected as the new tokenomics stabilize. |

| 2027 | $2.50 | $4.10 | $6.80 | +28% | Further network adoption and burn rates drive scarcity; possible integration with more telecom partners boosts demand. |

| 2028 | $2.80 | $5.00 | $8.50 | +22% | Steady network growth, continued token burns, and new subDAO use cases increase HNT’s utility and floor price. |

| 2029 | $3.30 | $5.80 | $10.00 | +16% | Maturing decentralized wireless sector; regulatory clarity may attract institutional capital, but competition from other DePIN projects grows. |

| 2030 | $3.80 | $6.50 | $12.00 | +12% | Widespread 5G/IoT network usage, with HNT as a core settlement asset. Network scaling and global expansion drive growth, but macro cycles can cause corrections. |

| 2031 | $4.20 | $7.20 | $14.00 | +11% | Helium cements its position as a leader in decentralized wireless. Deflationary tokenomics and strong network effects support higher valuations, though tech disruption risk remains. |

Price Prediction Summary

Helium (HNT) is poised for progressive price appreciation through 2031, driven by its unique burn-and-mint equilibrium, capped supply, and growing adoption of decentralized wireless networks. The introduction of subDAO tokens and a deflationary model post-2025 halving are expected to enhance scarcity and utility, supporting a bullish long-term outlook. However, price volatility will persist due to market cycles, regulatory uncertainties, and competition.

Key Factors Affecting Helium Price

- Deflationary tokenomics (burn-and-mint equilibrium) reducing HNT supply as network usage grows.

- Halving events decreasing new token emissions every two years.

- Increased adoption of 5G and IoT networks driving Data Credit demand and HNT burns.

- Expansion of subDAO tokens (IOT, MOBILE) and new network use cases.

- Potential partnerships with telecoms and enterprise users.

- Regulatory developments impacting DePIN and wireless networks.

- Competition from other decentralized infrastructure projects.

- Macro crypto market cycles and investor sentiment.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Halving Events and Deflationary Dynamics at $2.64

A critical feature underpinning Helium’s deflationary thesis is its halving schedule. With a capped supply of 223 million tokens and emissions reduced every two years, each halving event tightens new supply just as network demand accelerates. The most recent overhaul in 2025 reinforced this trajectory by combining emission cuts with aggressive circulating supply burns from actual wireless revenues.

The current market environment sees HNT at $2.64, slightly down 2.58% over the last day but well-positioned structurally as both emission halvings and real-time burns converge to create net-deflationary pressure – a rarity among crypto infrastructure projects.

For investors and operators alike, this convergence of burn rate and halving cycles is more than a tokenomics curiosity. It’s a living experiment in decentralized wireless sustainability, where every uptick in network usage translates into concrete value for the ecosystem. The transparent, on-chain nature of Helium’s model allows anyone to track how many HNT tokens are burned each month, providing unmatched visibility into the relationship between real-world adoption and token scarcity.

Unlike legacy wireless providers, Helium’s architecture flips the script: instead of hoarding spectrum or centralizing profits, it distributes economic rewards to those who build and maintain the infrastructure. This creates a virtuous cycle where grassroots deployment is incentivized, network coverage expands organically, and the underlying token economy grows stronger as adoption scales.

Decentralized Wireless Tokenomics: A Blueprint for Next-Gen Connectivity

The implications for decentralized wireless tokenomics are profound. As more DePIN projects emerge across IoT and 5G verticals, Helium’s burn-and-mint equilibrium offers a proven template for aligning user incentives with sustainable infrastructure growth. The network’s success hinges not on speculative hype but on actual demand, each device connected or gigabyte transmitted becomes another data point supporting HNT’s deflationary trajectory.

Key Advantages of Helium’s Deflationary Model

-

Direct Link Between Network Usage and Token Value: Helium’s burn-and-mint equilibrium (BME) ensures that as more data is transmitted, more HNT is burned to create Data Credits (DCs). This direct correlation ties token scarcity to real-world network demand, benefiting operators, users, and investors as network adoption grows.

-

Potential for Value Appreciation: With a capped supply of 223 million HNT and regular halving events, the circulating supply of HNT decreases over time. Combined with ongoing token burns, this scarcity model supports potential long-term price appreciation—reflected in the current HNT price of $2.64—which can attract and reward investors.

-

Sustainable Network Incentives: The model incentivizes hotspot operators by rewarding them in subDAO tokens like MOBILE and IOT, which can be converted to HNT or staked for governance. This creates a robust reward structure that supports both network growth and operator engagement.

-

Economic Alignment Across Stakeholders: By requiring HNT to be burned for DCs, both users and enterprises who utilize the network contribute to the token’s deflationary pressure. This aligns the interests of all participants, ensuring the network’s economic health is tied to its actual utility and adoption.

-

Governance and Ecosystem Participation: Staking HNT (including through vote-escrowed HNT, or veHNT) empowers participants in network governance, giving operators and investors a direct voice in protocol upgrades and future tokenomics decisions.

This approach also mitigates risks associated with unchecked inflation or misaligned incentives that have plagued other blockchain-powered wireless networks. By tying rewards to verifiable contributions, whether through hotspot uptime or data transmission, Helium ensures that value accrues where it matters most: at the edge of the network.

As we look ahead, much will depend on continued innovation within Helium’s governance structures (such as veHNT) and the ability to adapt emissions schedules in response to real-time market feedback. The interplay between subDAO tokens like MOBILE/IOT and core HNT economics will be especially critical as new use cases, from smart cities to edge AI, test the limits of decentralized connectivity.

Why Helium’s Model Matters at $2.64

With HNT priced at $2.64, Helium stands at a crossroads familiar to any disruptive technology: balancing short-term volatility with long-term fundamentals. Unlike speculative tokens untethered from utility, HNT’s value proposition is anchored in measurable network growth and transparent supply reduction mechanisms. This positions it uniquely among DePIN projects as both an infrastructure backbone and a store of value for believers in open wireless ecosystems.

The next chapter will likely see increased competition from both centralized carriers testing blockchain pilots and rival decentralized networks vying for market share. Yet few can claim a model as robustly intertwined with real-world utility, and as responsive to genuine demand, as Helium’s burn-driven economy.

If current trends continue, with millions in monthly revenue being burned into Data Credits and halvings constraining new supply, Helium could well serve as the archetype for how blockchain-powered wireless networks can scale sustainably while rewarding those who power their growth from the ground up.