The Helium Network is rapidly redefining the economics and architecture of wireless connectivity, emerging as a cornerstone for carrier offload in the decentralized wireless (DeWi) ecosystem. Fueled by blockchain incentives and a sprawling network of community-deployed hotspots, Helium is not only relieving congestion for major mobile operators but also generating new revenue streams for businesses and individuals alike. At its core, Helium’s model leverages underutilized Wi-Fi and cellular infrastructure, transforming them into dynamic assets that power real-world data transfer at scale.

Carrier Offload: The Engine Behind Decentralized Wireless Revenue

Carrier offloading is no longer just a technical buzzword – it is the mechanism driving tangible value across the Helium ecosystem. As mobile data demand surges, traditional carriers like AT and T and Telefónica have begun to embrace decentralized networks to manage peak traffic loads and extend coverage without massive capital expenditures. Instead of every device fighting for limited spectrum on congested towers, Helium enables seamless handoff to local hotspots, efficiently routing traffic over community-powered infrastructure.

Recent market data underscores this shift: In Q2 2025, the Helium Network offloaded over 2,721 terabytes of data from major U. S. mobile carriers – a staggering 138.5% increase from the previous quarter (source). This exponential growth is directly tied to high-profile partnerships and an aggressive $50 million grant program aimed at scaling coverage in key urban markets like New York City and Mexico City.

Helium Plus: Monetizing Unused Wi-Fi Capacity

The introduction of Helium Plus marks a pivotal moment for decentralized wireless revenue models. By allowing businesses and public Wi-Fi providers to seamlessly monetize excess bandwidth through carrier offload agreements, Helium unlocks new sources of passive income. In June alone, the network paid out over $300,000 to hotspot hosts for carrier offload data – with rewards climbing at 20% month-over-month.

This model democratizes network ownership: coffee shops, apartment buildings, and even individual users can now participate in the wireless economy without needing telecom expertise or regulatory licenses. The result is a virtuous cycle – as more hosts come online and coverage densifies, carriers gain greater incentive to offload traffic onto Helium’s robust mesh.

Top Ways Businesses Earn with Helium Plus in 2025

-

Monetizing Public Wi-Fi for Carrier Offload: Businesses hosting public Wi-Fi hotspots can now earn HNT rewards by enabling Helium Plus, which allows major carriers like AT&T and Telefónica to offload mobile data onto their networks. In Q2 2025, over 2,721 terabytes of carrier data were offloaded, directly translating to increased payouts for Wi-Fi providers.

-

Deploying Dedicated Helium Hotspots: By installing and maintaining Helium-compatible hotspots, businesses facilitate decentralized wireless coverage and receive monthly HNT payouts based on the volume of carrier traffic offloaded. In June 2025 alone, network participants collectively earned over $300,000 from carrier offload data.

-

Participating in Coverage Expansion Grant Programs: Through Helium’s $50 million grant initiative, businesses expanding network coverage—especially in target cities like New York and regions across the U.S. and Mexico—can access funding and additional incentives for deploying infrastructure that supports carrier offload.

-

Partnering with Major Telecom Operators: Enterprises collaborating directly with telecom giants such as AT&T and Telefónica Movistar to provide offload-ready infrastructure benefit from long-term, volume-based revenue streams as these carriers increasingly rely on Helium’s decentralized model to reduce costs and enhance coverage.

-

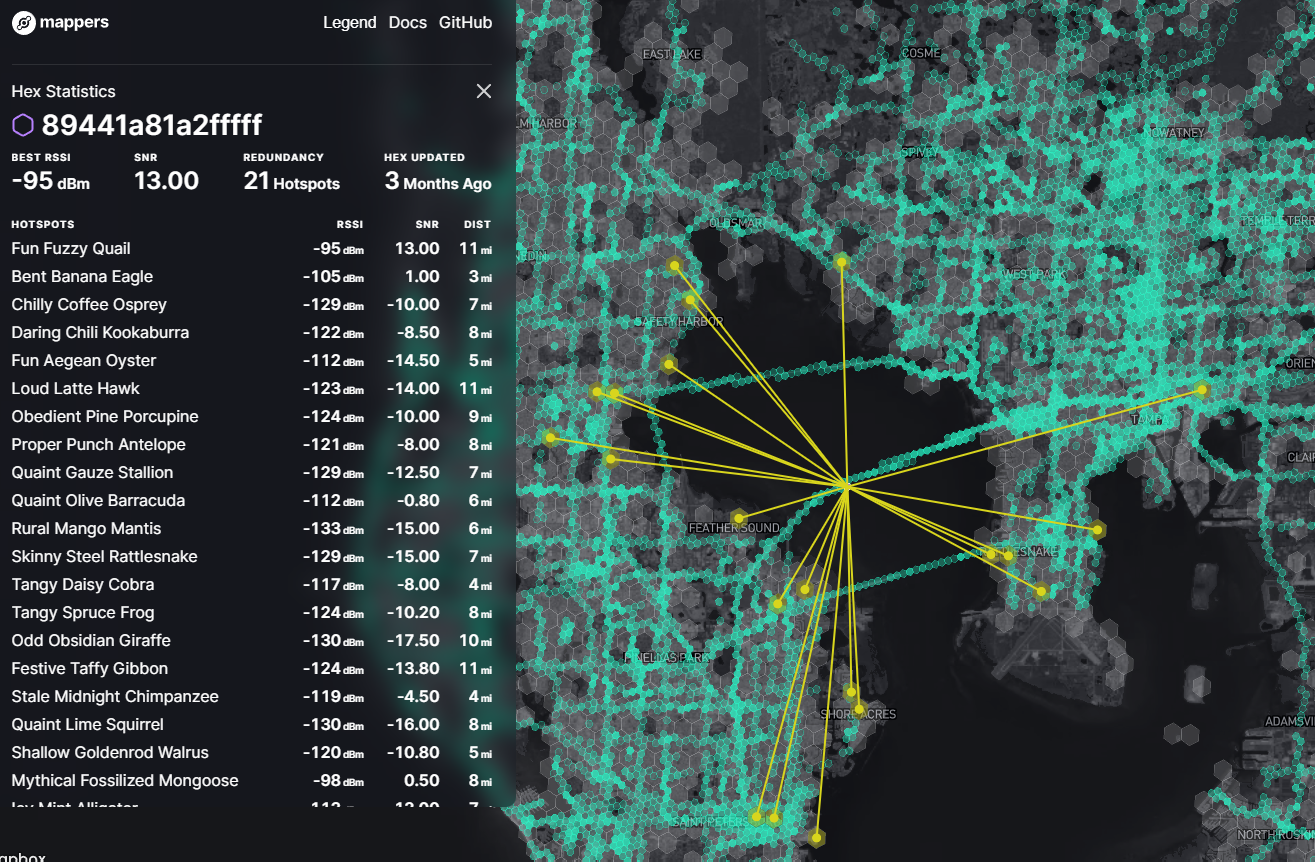

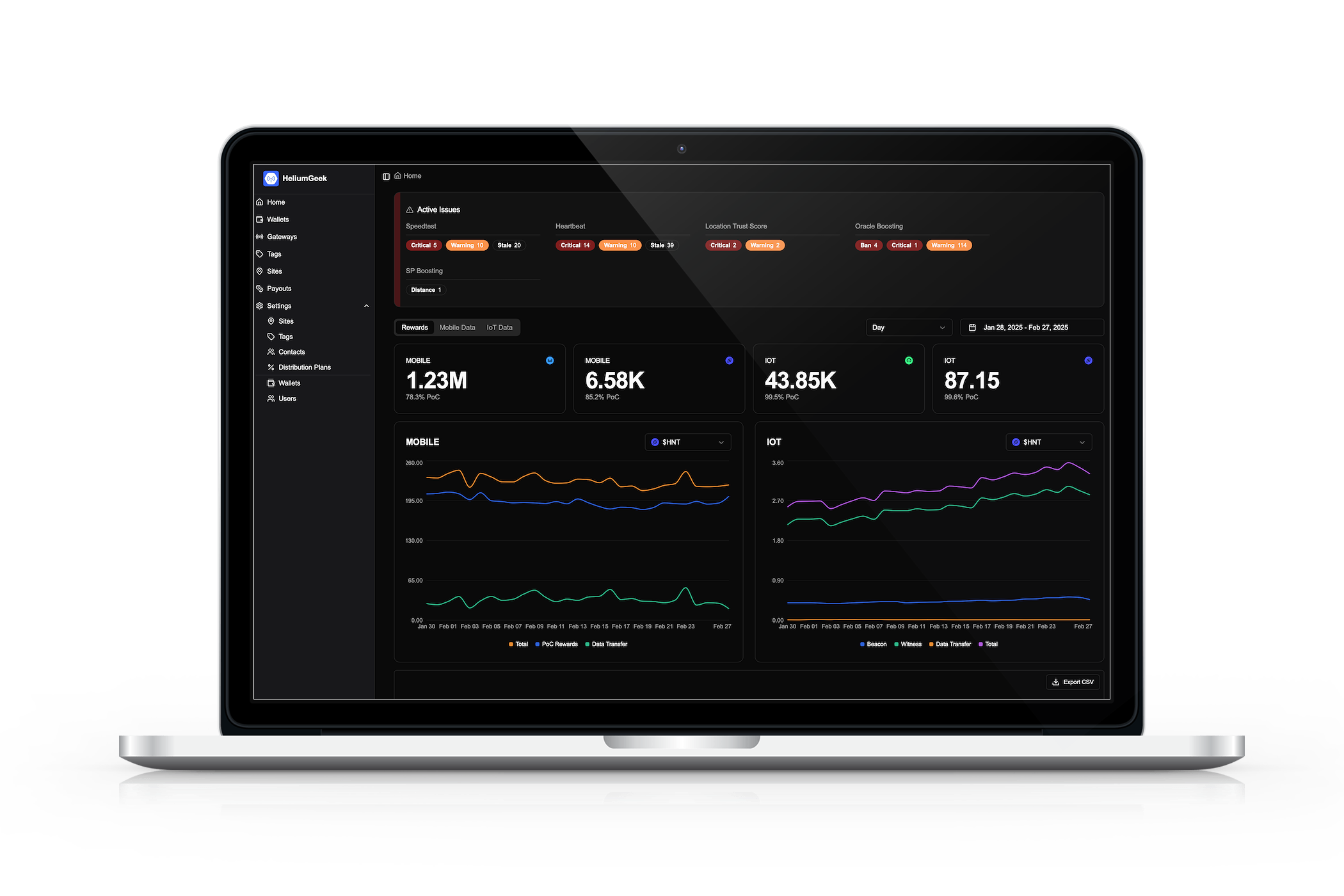

Leveraging Analytics and Optimization Tools: Businesses utilizing Helium’s analytics platforms can optimize hotspot placement and network performance to maximize offload volumes and, consequently, their HNT earnings. Advanced dashboards help identify high-traffic areas and adjust deployments for greater profitability.

Real-World Impact: From Urban Coverage to User Earnings

The impact of carrier offload on decentralized networks extends far beyond technical efficiency – it is reshaping how value flows across the wireless landscape. For major cities facing persistent dead zones or overloaded macro towers, Helium-powered hotspots act as hyper-local express lanes for mobile data. This not only enhances user experience but also provides critical redundancy during emergencies or large public events.

For participants in the ecosystem, the financial upside is increasingly compelling. With HNT trading at $2.55, hosts are seeing meaningful returns on their hardware investments through consistent token rewards tied directly to real-world usage metrics. As reward pools expand alongside rising carrier adoption rates, hotspot earnings are becoming less speculative and more utility-driven – aligning incentives between deployers and end users.

Helium (HNT) Price Prediction 2026-2031

Forecast based on current adoption trends, carrier offload growth, and technology expansion as of October 2025.

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg) |

|---|---|---|---|---|

| 2026 | $2.10 | $3.00 | $4.20 | +17.6% |

| 2027 | $2.50 | $4.10 | $6.00 | +36.7% |

| 2028 | $3.20 | $5.60 | $8.50 | +36.6% |

| 2029 | $3.80 | $7.20 | $12.00 | +28.6% |

| 2030 | $4.40 | $9.00 | $16.00 | +25.0% |

| 2031 | $5.00 | $11.50 | $21.00 | +27.8% |

Price Prediction Summary

Helium (HNT) is positioned for steady growth through 2031, driven by exponential carrier offload adoption, major telecom partnerships, and expanding decentralized wireless use cases. While short-term volatility is likely, the network’s real-world utility and revenue streams provide a strong foundation for long-term appreciation. Bullish scenarios see HNT reaching double-digit prices as adoption accelerates, while bearish cases reflect potential regulatory or competitive setbacks.

Key Factors Affecting Helium Price

- Continued growth in carrier offload volumes and monthly rewards, underpinned by partnerships with AT&T, Telefónica, and other telecoms.

- Expansion of Helium Plus and incentive programs driving network participation and coverage, especially in major urban markets.

- Scaling through $50 million grant initiatives, broadening reach in the US and Mexico.

- Potential regulatory clarity or obstacles impacting decentralized wireless adoption.

- Technological upgrades, improved tokenomics, and new enterprise use cases enhancing demand for HNT.

- Competition from other decentralized and traditional wireless solutions.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

“Carrier offloading on decentralized networks isn’t just about saving costs for telecoms – it’s about unlocking a new era of participatory infrastructure where everyone can earn from digital connectivity. “

Helium’s carrier offload model is now a proven engine for decentralized wireless revenue, but its implications run even deeper for the telecom sector and the broader DePIN (Decentralized Physical Infrastructure Networks) movement. As traditional operators face mounting pressure to deliver consistent, high-speed coverage in dense urban cores and underserved rural areas, leveraging Helium’s blockchain-powered mesh is a capital-light alternative to endless tower buildouts. The network’s ability to dynamically route traffic, wherever coverage is needed, has made it an increasingly attractive partner for major carriers seeking both resilience and cost efficiency.

What’s particularly innovative is how Helium’s model flips the script on legacy infrastructure ownership. Instead of centralizing control, it distributes both responsibility and reward to a diverse set of stakeholders. With the $50 million grant program accelerating rollout in New York City, Los Angeles, and Mexico City, the network’s expansion is not just top-down but grassroots-driven. This decentralized approach is already yielding measurable improvements in coverage and service quality, especially in areas where traditional carriers have struggled to justify further investment.

For businesses and individuals, the economics are straightforward and increasingly transparent. Hosting a Helium hotspot is no longer a speculative bet but a data-driven opportunity. Payouts for carrier offload are algorithmically determined by actual usage, and the introduction of Helium Plus has streamlined onboarding for enterprise Wi-Fi providers and small businesses alike. The result: a rapidly growing cohort of hosts earning consistent, utility-backed rewards.

Decentralized Wireless Revenue: Sustainable, Scalable, and Transparent

Transparency and scalability are at the heart of Helium’s appeal. Unlike opaque carrier roaming agreements, every byte of offloaded data is tracked and rewarded on-chain, providing unmatched accountability for both hosts and carriers. This is particularly relevant as regulatory scrutiny intensifies around net neutrality and spectrum allocation, Helium’s open ledger offers a verifiable record of network activity, usage, and compensation.

As of Q2 2025, HNT is trading at $2.55, reflecting both growing market confidence and real-world adoption. The tokenomics are designed to reward productive activity, namely, data transfer for carrier offload, rather than speculative staking or idle hardware. This utility-first approach is driving a new wave of adoption among both institutional partners and grassroots deployers.

“Helium is quietly rewriting the rules of wireless infrastructure by aligning incentives across the entire connectivity stack. The result is a more resilient, flexible, and inclusive network, built not by a single corporation, but by thousands of independent contributors. “

Looking ahead, the Helium Network’s trajectory suggests that decentralized wireless revenue will only become more integral to telecom strategy. As offload volumes continue their meteoric rise and reward pools expand, expect to see even broader participation, from local governments seeking digital equity to global carriers optimizing for efficiency and reach.

For a deeper dive into how major U. S. networks are leveraging Helium’s decentralized hotspots for carrier offload, check out our in-depth guide here.