Picture this: you’re at a packed stadium during a championship game, or weaving through the chaos of LAX airport. Thousands of IoT devices, smart sensors tracking crowds, vending machines updating inventory, even wearables monitoring health, are vying for connectivity. Traditional 5G towers, those behemoths dominating skylines, often buckle under the strain in such dense spots. Enter Helium hotspots, the plucky underdogs revolutionizing decentralized wireless dense areas with resilient IoT coverage. In 2025, with over 900,000 hotspots worldwide, Helium is proving that community-powered networks can outmaneuver centralized giants.

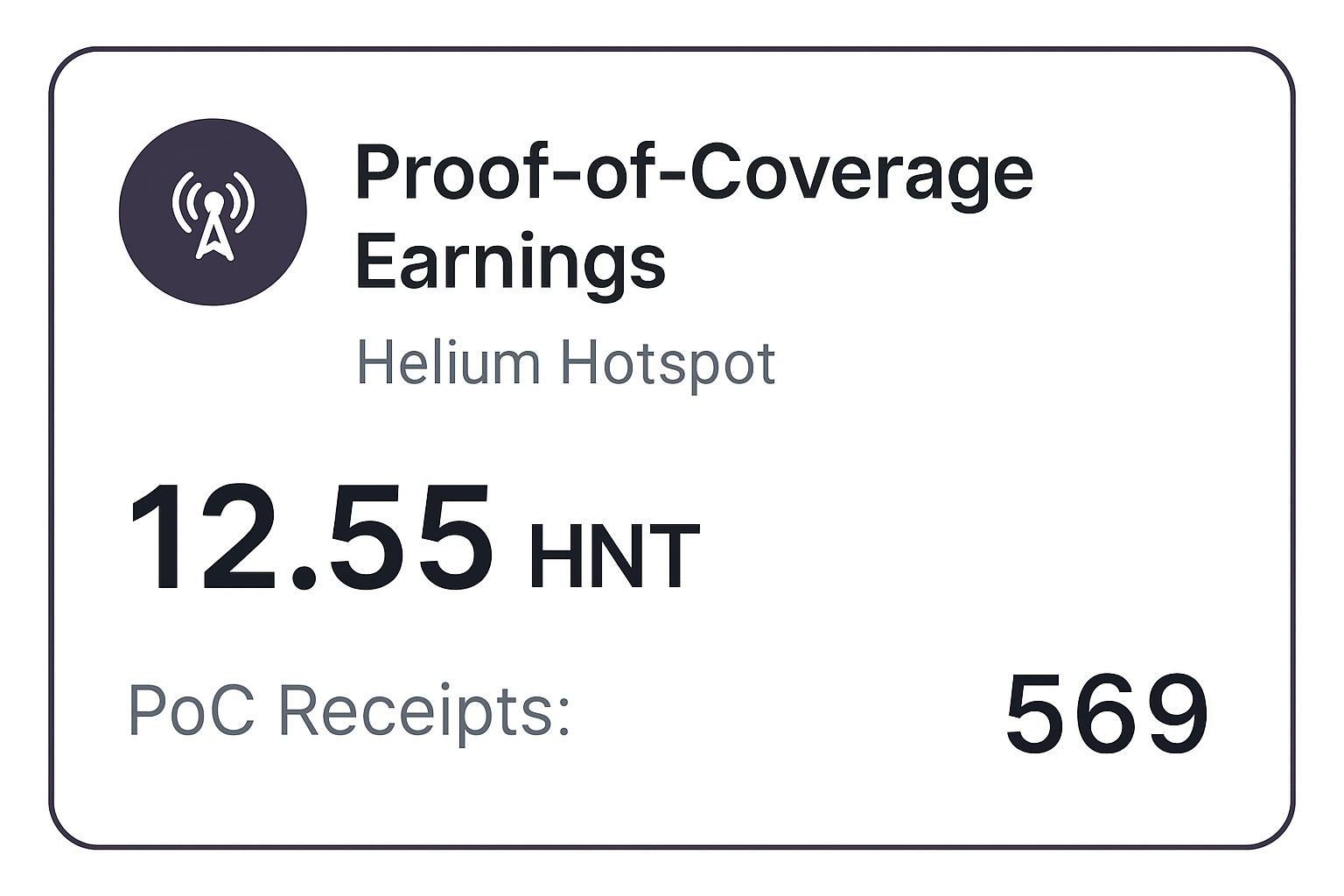

Helium’s model flips the script on infrastructure. Anyone can plug in a hotspot, earn HNT tokens, currently at $1.94: for providing real coverage verified by Proof-of-Coverage. This isn’t hype; Q3 2025 saw IoT hotspots climb 9.5% quarter-over-quarter to 42,640 since the Solana migration. Meanwhile, the full network hit 900,000 devices, offloading 2721TB in Q2 alone to 1.16M daily active users. It’s Helium hotspots 5G comparison at its finest: low-cost, scalable, and tough where it counts.

Why Traditional 5G Towers Struggle in Urban Jungles

Building a 5G tower? Think millions in upfront costs, endless permits, and years of red tape. Telecoms like AT and amp;T pour billions into these steel sentinels for broad coverage, but dense areas expose their flaws. Signal interference from buildings, skyrocketing demand during events, and maintenance nightmares make them brittle. In stadiums or airports, where DePIN IoT coverage stadiums is critical, towers hit capacity limits fast. Deployment lags too, 5G-Advanced and edge computing trends demand agility that centralized ops can’t match.

Contrast that with Helium. Hotspots are compact, indoor-friendly devices acting as mini cell towers. They support LoRaWAN for low-power IoT and 5G for bandwidth hogs, all on blockchain rails. No mega-capex; individuals and enterprises deploy them for pennies, earning from data offload and coverage proofs. Helium’s pivot to Wi-Fi alongside 5G, ditching CBRS hurdles, unlocked deals for massive cellular offloading. Result? Networks that flex with demand, perfect for 2025’s AI-driven, satellite-hybrid connectivity landscape.

Helium’s Edge: Rapid Scaling and Real Resilience

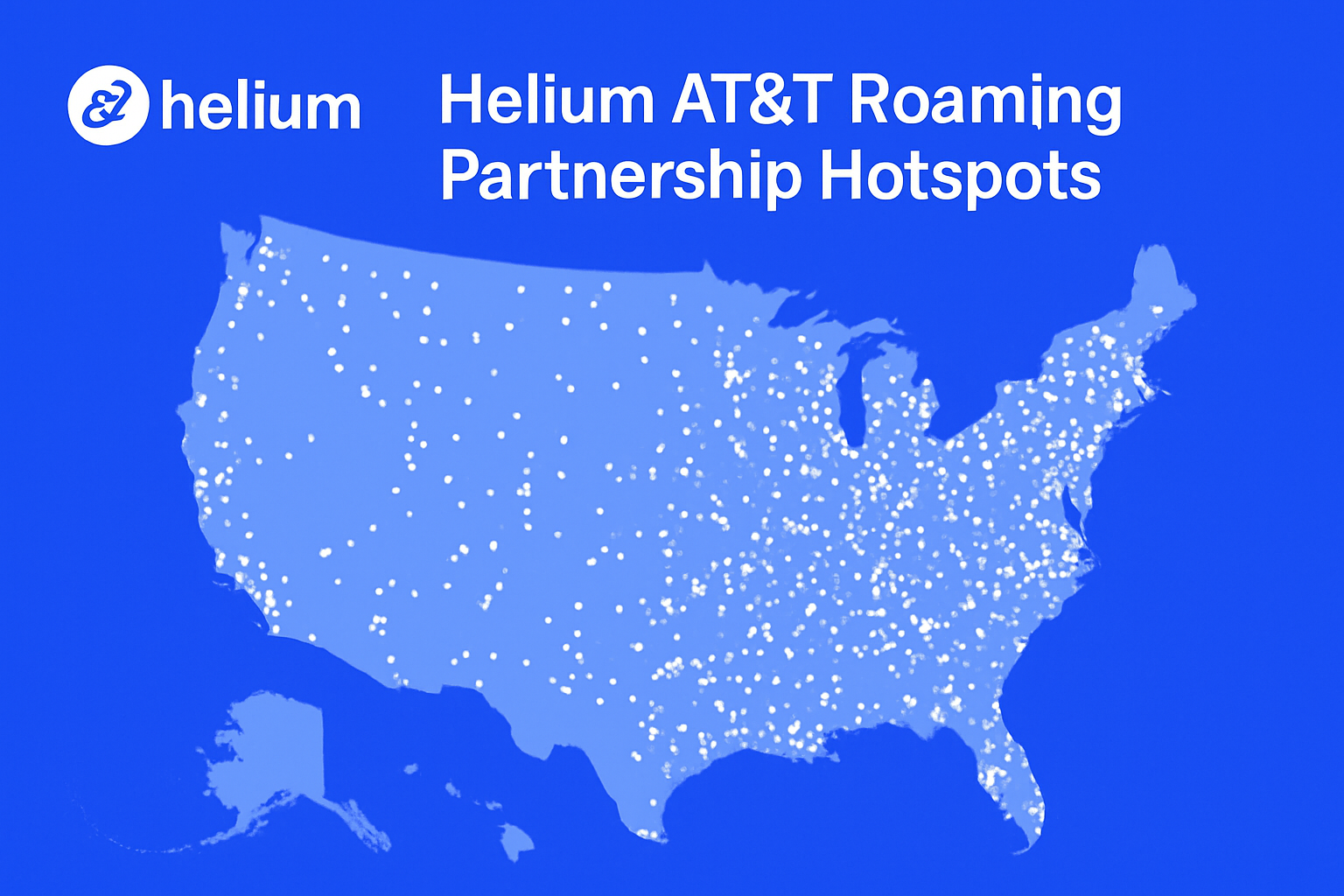

Numbers don’t lie. Helium Mobile hotspots jumped 12.5% QoQ in Q1 2025, new units from 28,100 to 31,600, excluding conversions. By Q4, IoT side grew 20%, pushing totals past 375,000, now at 900,000 and. Monthly fees hit $1.7M across DePIN WiFi and IoT. Partnerships seal the deal: April 2025’s AT and amp;T tie-up lets subscribers roam seamlessly onto Helium 5G, bolstering coverage where towers falter. Airports like LAX now test decentralized hotspots, ensuring your phone stays lit amid traveler hordes.

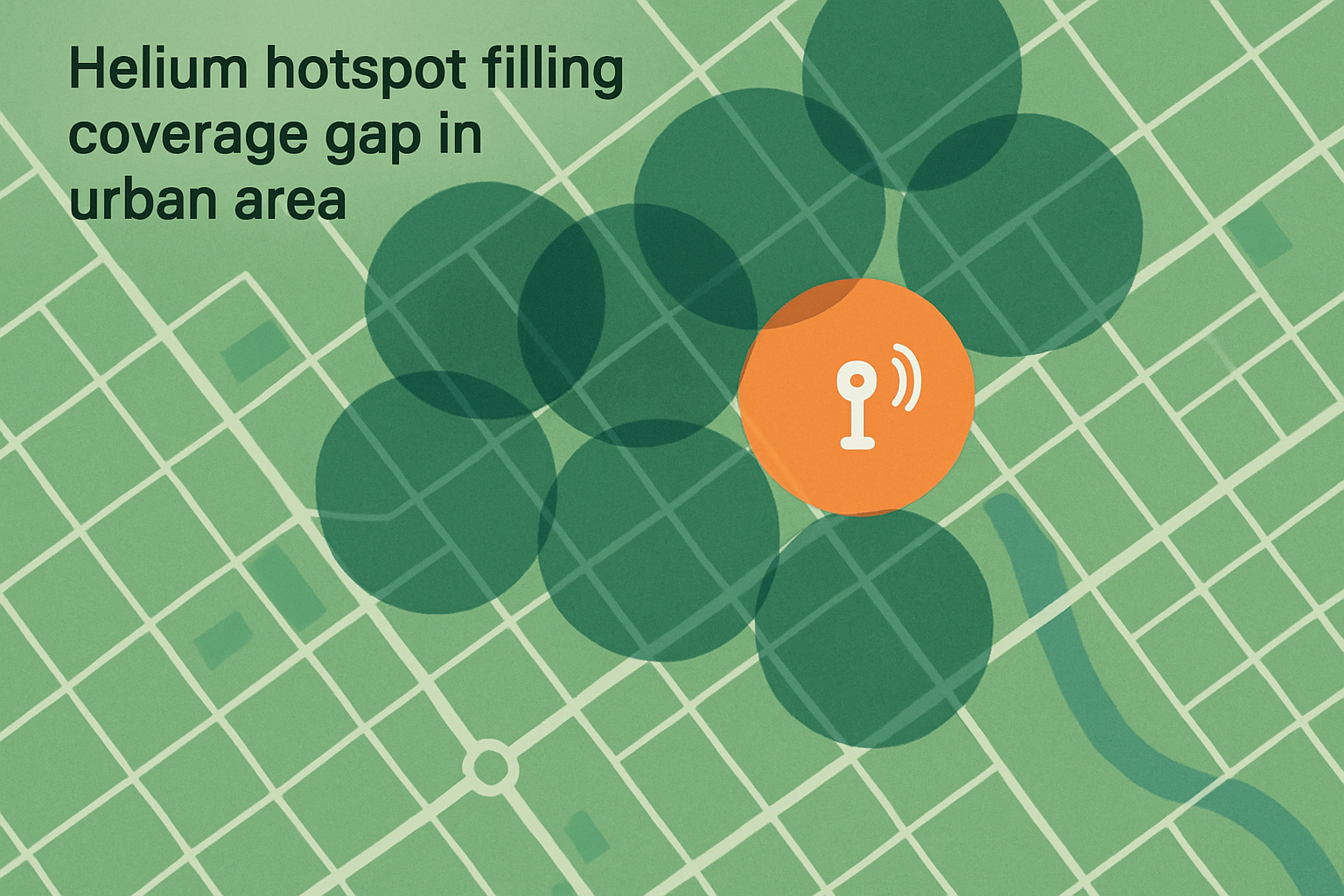

This is 5G tower alternatives DePIN in action. Helium’s Helium network resilience 2025 shines in enterprises too, 400K and hotspots powering IoT fleets. Forget rigid hierarchies; decentralized means hotspots self-organize, filling gaps dynamically. In dense urban zones, where traditional infra chokes, Helium delivers. Check our deep dive on urban IoT networks for more proof.

Economics and Incentives Fueling the Hotspot Boom

Earning HNT at $1.94 incentivizes deployment. Hotspot owners mine via coverage challenges, no energy-guzzling PoW. With MOBILE token utility expanding, projections look bullish. Enterprises offload traffic, cutting costs; users get reliable IoT links for sensors in smart cities or stadiums.

Helium MOBILE (MOBILE) Price Prediction 2026-2031

Projections based on DePIN network expansion, AT&T partnerships, IoT/5G adoption, and market cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $0.0015 | $0.0040 | $0.0100 | +100% |

| 2027 | $0.0030 | $0.0080 | $0.0200 | +100% |

| 2028 | $0.0050 | $0.0150 | $0.0400 | +88% |

| 2029 | $0.0080 | $0.0250 | $0.0600 | +67% |

| 2030 | $0.0120 | $0.0400 | $0.1000 | +60% |

| 2031 | $0.0180 | $0.0600 | $0.1500 | +50% |

Price Prediction Summary

Helium MOBILE is forecasted to see strong growth from 2026-2031, driven by hotspot proliferation beyond 900,000, telecom integrations like AT&T roaming, and rising DePIN demand for resilient IoT/5G coverage in urban areas. Average prices could rise 10x+ by 2031 in bullish adoption scenarios, with min/max reflecting bearish regulatory hurdles vs. explosive network utility.

Key Factors Affecting Helium MOBILE Price

- Rapid hotspot growth (900K+ in 2025, targeting millions)

- AT&T partnership enabling seamless 5G roaming

- Shift to Wi-Fi/CBRS for urban dense coverage

- Increasing IoT data offload (2721TB Q2 2025) and DAUs (1.16M)

- Favorable DePIN trends and enterprise adoption

- Crypto market cycles and regulatory clarity on decentralized networks

- Competition from traditional 5G but advantages in cost/flexibility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Helium hotspots aren’t just cheaper, they’re smarter. Proof-of-Coverage ensures genuine range, unlike tower claims. In 2025, as 5G evolves, this DePIN approach promises unbreakable IoT backbones in the tightest spots.

Take LAX airport, for instance. Travelers swarm terminals, IoT sensors monitor air quality and foot traffic, yet connectivity holds steady thanks to Helium 5G hotspots tucked into ceilings and corners. These deployments prove DePIN IoT coverage stadiums isn’t a pipe dream; it’s live, handling peak loads where traditional towers overload. Similarly, packed venues like stadiums benefit from hotspots clustering to boost signal density, offloading terabytes without a hitch.

Head-to-Head: Hotspots Crush Towers in Key Metrics

Let’s break it down. Traditional 5G towers excel in rural sweeps but falter up close. Helium hotspots thrive exactly where density spikes, offering granular control. Enterprises love this; with 400,000-plus units fueling IoT fleets, they’ve offloaded 2721TB in Q2 2025 alone, serving 1.16 million daily users. The AT and T partnership from April 2025 supercharges this, letting subscribers hop onto Helium seamlessly, blending decentralized grit with telecom muscle.

Helium Hotspots vs. Traditional 5G Towers: Key Metrics Comparison (2025)

| Metric | Helium Hotspots | Traditional 5G Towers |

|---|---|---|

| Deployment Cost | Low ($500 per hotspot) | Millions per tower |

| Time to Deploy | Days | Years |

| Dense Area Resilience | High, self-healing | Prone to overload |

| Scalability | Community-driven (900K+ hotspots globally) | Centralized permits |

| IoT Support | LoRaWAN and 5G | 5G only |

These metrics highlight why Helium leads in decentralized wireless dense areas. Hotspots cost around $500 upfront, deploy in days from a windowsill, and scale via incentives tied to HNT at $1.94. Towers? Massive bills, bureaucratic delays, and static footprints that ignore micro-gaps in urban mazes.

The Human Touch: Stories from Hotspot Heroes

Key Advantages of Helium Hotspots

-

Earn passive HNT income at $1.94 via Proof-of-Coverage, rewarding coverage provision on the network with over 900,000 hotspots globally.

-

Fill coverage gaps in your neighborhood or business, delivering decentralized IoT and 5G where traditional towers fall short.

-

Power resilient IoT for smart cities and events, supporting LoRaWAN sensors to high-bandwidth devices seamlessly.

-

Tap into AT&T roaming (April 2025 partnership), enabling AT&T users to roam on Helium’s 5G for massive impact.

-

Future-proof against 5G-Advanced shifts with Helium’s rapid, low-cost decentralized expansion in dense areas.

Hotspot owners aren’t faceless miners; they’re neighbors, shopkeepers, enterprises turning connectivity into cash flow. One airport vendor deployed a dozen units, slashing data costs while monitoring stock in real-time. Stadium operators cluster them for event surges, ensuring fan apps and safety sensors never drop. This grassroots energy builds Helium network resilience 2025, outpacing lumbering telcos.

Challenges exist, sure. Token volatility around $1.94 tests resolve, and regulatory nods for Wi-Fi pivots keep teams nimble. Yet growth persists: 900,000 hotspots strong, IoT up 20% in Q4, Mobile fees at $1.7 million monthly. As Open RAN and edge computing mature, Helium integrates effortlessly, positioning DePIN as the agile alternative.

Zoom out, and the vision clarifies. In a world of exploding IoT, from wearables to autonomous drones, centralized towers can’t keep pace alone. Helium hotspots deliver 5G tower alternatives DePIN that are resilient, inclusive, and profitable. Whether you’re an investor eyeing HNT at $1.94, a business seeking edge coverage, or a tech fan, this network redefines dense-area dominance. Deploy one, watch the magic unfold, and own a slice of tomorrow’s wireless revolution.